Retail banking customers today expect nothing less than exceptional convenience and accessibility at all times. However, serving their needs in a complex regulatory and technological context is often related to financial fraud. In an environment where cybercriminals constantly devise new tactics, the retail banking sector must keep up.

Fortunately, artificial intelligence (AI) has become a game-changer in the fight against financial fraud. Thanks to advanced machine learning algorithms, financial institutions can now detect, prevent, and mitigate fraud with speed, accuracy, and adaptability.

This article discusses fraud detection using AI in banking. It also explores how it is revolutionizing the industry’s approach to safeguarding transactions and protecting customers.

The escalating threat of financial fraud

More financial services consumers than ever before are relying on online and mobile platforms. This rapid digital transformation has also paved the way for a surge in fraudulent activities.

According to industry reports, the global cost of cybercrime will reach $6 trillion annually by 2024, and the financial services sector will take the biggest hit. Fraud attempts have skyrocketed.

From identity theft and phishing to account takeovers and document forgery, the arsenal of financial criminals continues to expand, posing considerable challenges to financial institutions.

Source: arya.ai

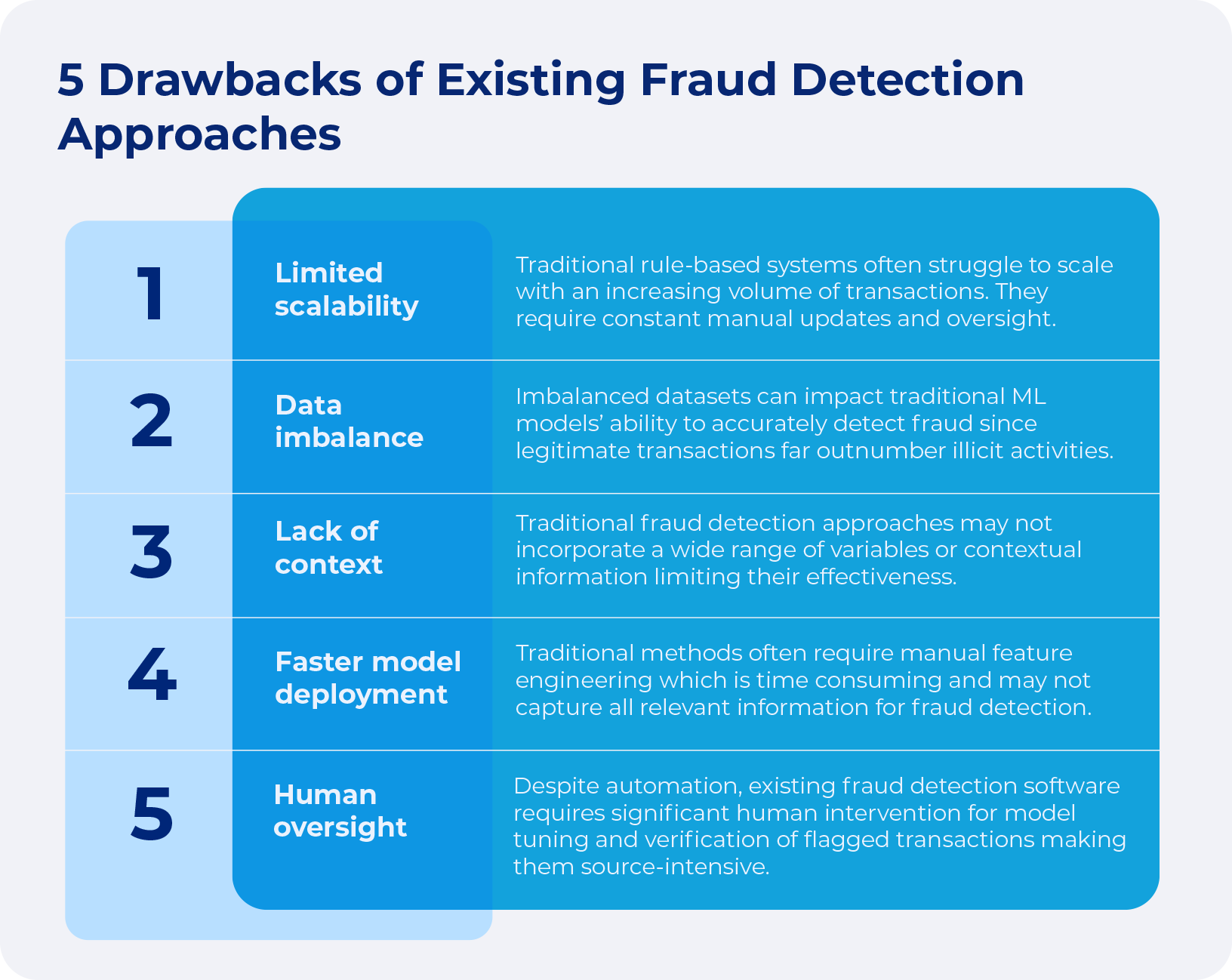

The limitations of traditional fraud detection methods

Historically, financial institutions have relied on a combination of rule-based systems and human expertise to detect and prevent fraud. These methods are proving inadequate in the rapidly evolving fraud landscape.

Rule-based systems, for instance, can only identify patterns and anomalies they are programmed to recognize. The manual review process required to investigate these alerts can be lengthy, consuming valuable time that employees can devote to more strategic initiatives.

Source: oscilar.com

The power of AI in fraud detection

The limitations of traditional fraud detection methods have paved the way for AI-powered solutions, which offer a more robust approach to safeguarding financial transactions. By harnessing machine learning (ML) algorithms, AI-based fraud detection in banking analyzes large amounts of data, identifies complex patterns, and adapts to evolving fraud tactics quickly and accurately.

Efficiency and accuracy of the fraud detection process

AI-powered fraud detection systems can process and analyze massive volumes of data in real-time, far surpassing the capabilities of manual review processes or rule-based systems. These advanced algorithms can sift through billions of transactions, detect anomalies, and flag potential fraud with a high degree of precision, reducing the error margin and the incidence of false positives.

Real-time fraud detection and prevention

AI-driven fraud detection tools can identify suspicious activities in real-time and this is one of their biggest advantages. By continuously monitoring transactions, user behavior, and other financial activities, these systems can rapidly detect and respond to emerging threats, often before any significant damage is incurred.

Adaptive and self-learning capabilities

Unlike static rule-based systems, AI-powered fraud detection learns and adapts over time by design. By continuously processing new data and using feedback from human analysts, these algorithms refine their capabilities, staying one step ahead of the tactics that cybercriminals employ and constantly evolve.

Detecting fraud for enhanced customer experience

Effective fraud detection is about protecting the financial institution and preserving the customer experience. AI-powered systems can minimize the number of false positives, ensuring that legitimate transactions are processed seamlessly while still maintaining a robust defense against fraudulent activities.

Key applications of AI in banking fraud detection

AI’s impact on fraud detection in the banking and financial services sector can be seen across a wide range of applications, each targeting specific types of fraudulent activities.

Identity theft and synthetic fraud

Identity theft and synthetic fraud, where fraudsters create entirely fabricated identities, pose significant fraud risks to financial institutions. AI-powered identity verification solutions, leveraging advanced biometric technologies and document checks, can effectively detect and prevent these sophisticated attempts at impersonation.

Account takeover fraud

Account takeover fraud, where criminals gain unauthorized access to customer accounts, can be mitigated through AI-powered behavioral analytics. These systems can detect anomalies in user activity, such as unusual login patterns or transaction volumes, and trigger immediate security measures to protect the account.

Deepfake fraud

The emergence of deepfake technology, which enables the creation of highly convincing fake audio, images, and videos, has introduced a new frontier in financial fraud. AI-powered deepfake detection algorithms can analyze biometric data, such as facial movements and voice patterns, to identify and prevent these sophisticated impersonation attempts.

Money laundering, suspicious and fraudulent transactions

AI-driven anti-money laundering (AML) solutions can help financial institutions comply with regulatory requirements and detect suspicious transactions that may mean money laundering or other illicit financial activities. These systems leverage advanced analytics to identify anomalies, flag high-risk transactions, and support comprehensive investigations.

The impact of AI-driven fraud detection

The implementation of AI-powered fraud detection solutions has had an impact on the banking and financial services industry, delivering tangible benefits that extend beyond mere fraud prevention.

Improved fraud detection rates

By leveraging the superior pattern recognition and anomaly detection capabilities of AI, financial institutions have become better at identifying and preventing fraudulent activities. In some cases, the adoption of AI-driven fraud detection has led to a doubling of fraud detection rates, highlighting the technology’s effectiveness.

Reduced operational costs

The automation and efficiency of AI-powered fraud detection systems have resulted in substantial cost savings for financial institutions. By minimizing the need for manual review processes and reducing the number of false positives, these solutions have enabled organizations to allocate resources more effectively, focusing on strategic initiatives rather than reactive fraud management.

Enhanced customer experience

AI-driven fraud detection has had a positive impact on the customer experience, as it has helped to streamline the transaction process and reduce the friction associated with security measures. By accurately identifying and addressing fraudulent activities, these systems have contributed to increased customer trust and satisfaction, ultimately strengthening the financial institution’s brand reputation.

Improved regulatory compliance

The ability of AI-powered fraud detection systems to rapidly identify and respond to suspicious activities has proven invaluable in meeting regulatory requirements. Financial institutions can leverage these solutions to enhance their compliance and mitigate the risk of fines.

Overcoming the challenges of AI for fraud detection in banking

While the benefits of AI-powered fraud detection are substantial, financial institutions must also navigate a range of challenges related to the implementation of AI in general. On top of that, they have to be aware of the issues that can potentially arise when using it for fraud detection exclusively.

Addressing false positives

One of the primary concerns with AI-driven fraud detection is the potential for false positives, where legitimate transactions are flagged as fraudulent. Financial institutions must carefully calibrate their AI models to strike the right balance between detection accuracy and customer experience, minimizing the impact of these erroneous alerts.

Ensuring transparency

As AI systems become more complex, financial institutions must focus on transparency to build trust with their users and remain compliant. Stakeholders, including customers and regulators, must be able to understand the decision-making process behind the AI’s fraud detection recommendations.

Integrating AI with legacy systems

Many financial institutions operate with a patchwork of legacy systems and infrastructure, which can pose challenges in integrating AI-powered fraud detection solutions. Careful planning, system integration, and data harmonization are crucial to ensuring the successful deployment of these technologies.

Conclusion

Thanks to AI solutions, fraud detection in retail banking is now more accurate and fast. The risk of blocking genuine customers is also lower, resulting in enhanced user experience. In this process, AI algorithms are essential for catching fraudulent activities by handling big volumes of data in real time. However, in order to reap maximum benefits of the technology, retail banks must implement AI responsibly and address the potential challenges it brings along.