We Build User-Centric Solutions That Put Smart Finance at Your Clients’ Fingertips

In today’s competitive financial landscape, digital-first financial organizations must deliver cutting-edge solutions while also ensuring their robust growth. Navigating this complex environment involves more than just staying alert to technology and industry trends; it requires a strategic financial software partner who can understand your business needs and execute them. Fast.

At Scalefocus, we deliver custom financial software solutions and services that empower FinTechs and other financial companies to not only adapt to market dynamics – such as competition, Big Tech involvement, regulation, consumer behavior, and economic conditions – but to excel beyond them. Our expertise lies in understanding the industry, delivering innovative financial solutions through accelerators and cutting-edge technology, and addressing sector-specific compliance. We ensure all of this while delivering an outstanding customer experience for your end users and maintaining the highest quality of development.

Transform your unique value proposition into a powerful differentiator

While many financial software service providers can speed up your operations, most of them offer only generic tech capabilities that are largely a commodity in today’s market. In contrast, we help you deliver unique value to your clients with our top-tier financial solutions and a dedicated, tailored approach.

Our greatest strength lies not only in understanding your specific business case and how it fits within the broader industry landscape but also in applying over a decade of experience and industry know-how. We minimize technical complexity and eradicate tech debt, enabling you to gain a significant competitive advantage.

Watch how we move the needle in finance with technology

Core Focus Areas

It’s no accident that instant payments and embedded finance are on the rise—today’s consumers demand effortless financial management. However, the market still faces complex regulations and an unharmonized payment infrastructure. Financial players looking to bridge this gap struggle with integration difficulties, interoperability and scalability issues, and data fragmentation. In this context, we help companies with integration services, real-time monitoring of regulatory changes, scalable cloud-based infrastructure, and solutions that scale effectively across different regions and payment methods.

Our tech toolbox

- Integrating Advanced Payment Gateways

- Microservices & API Development

- Infrastructure Management

- Leveraging Data Analytics for Valuable Insights

Digital wallets offer customers unprecedented convenience, security, and personalization. For banks and FinTechs they hold strategic importance for revenue generation, customer acquisition and retention, as well as for the capitalization of emerging market trends. Our experts are proficient in creating digital wallets with customer-first user interfaces, developing backend systems, and ensuring smooth integration with existing banking or FinTech systems, as well as with third-party APIs.

Our tech toolbox

- White Label Solution Development & Backend Integrations

- Scalable Custom Solution Development (collections, reconciliation, CRM)

- External API Development & Enhancement of Developer Experience

Open Banking APIs provide banks and FinTechs with opportunities to offer clients enhanced product features and improved ease of use. However, implementing Open Banking involves more than simply integrating another API; it often affects various aspects of the internal IT landscape, whether it’s comprised of legacy systems or more modern technology. Our team develops secure, scalable, and compliant APIs allowing financial companies to leverage external innovation and offer more comprehensive financial services to customers.

Our tech toolbox

- Enterprise and System Architecture Assessment

- API Development for White Label Products

- API Gateway and Management

- Open Banking Platform Development

- System Integration

We utilize effective design principles to re-imagine and deliver your digital financial products with memorable human-centered design. We alleviate blind spots in the customer experience journey, covering the entire financial product development lifecycle to ensure its continuity. Our design team gathers data from stakeholders and user personas to provide the highest-quality user experience.

Our tech toolbox

- Workshops, Stakeholder & User Interviews, Focus Groups, UX Evaluation

- UI/UX Design, Conceptualizing, Prototyping, Testing, and Iteration

- Validation from Concept to Launch, Continuous Usability Testing and Optimization

- User Journey Optimization: A/B testing & Analytics, Customer Journey Mapping, Personalization Engines

To transform raw data into valuable assets, drive new revenue streams, and enhance business performance, financial organizations must have a holistic data strategy to optimize how they gather, store, and process it. As an end-to-end financial technology service provider, we offer strategic consulting and development of data management, infrastructure, and concept planning. Our team helps you face the challenges related to data quality and integration, regulatory compliance, and the use of AI in finance.

Our tech toolbox

- Data strategy, Database Architecture and Design, Data Modeling

- Migration from On-prem to Cloud, Advanced Data Analytics

- Data Warehousing and Business Intelligence

- Custom AI Implementations & Integration of AI Models

- Data Engineering & Management for AI

Reduce friction and boost retention with our embedded payments solution

Enterprise AI for

Future-Ready Finance

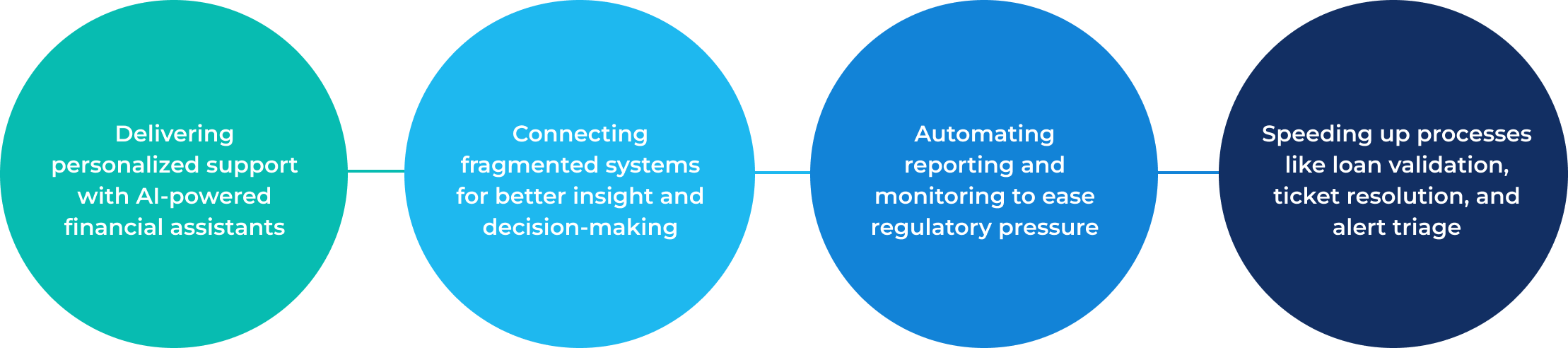

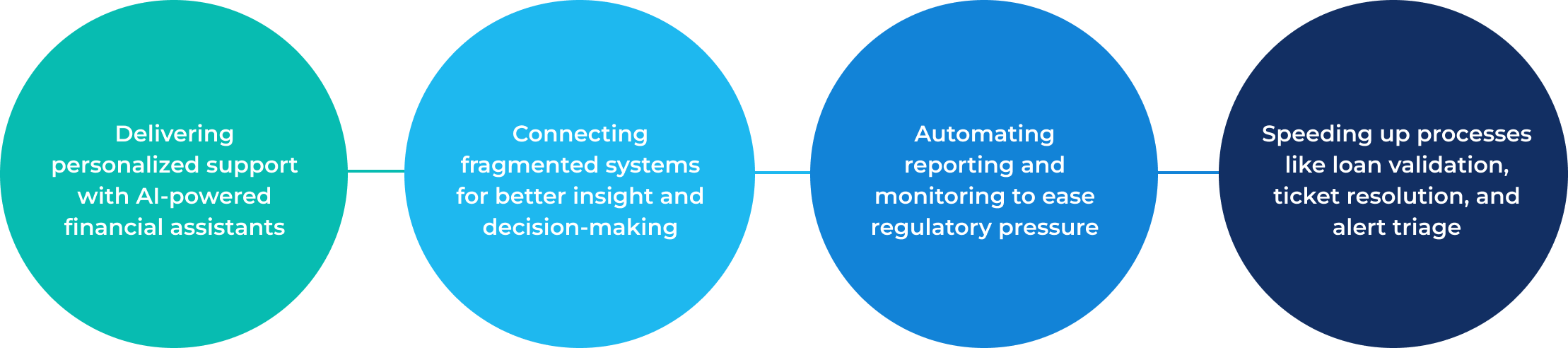

Banks and FinTechs are under pressure to cut costs, stay compliant, and keep customers engaged, all while managing huge, fragmented data estates. Scalefocus Enterprise AI addresses these challenges in one place: it unifies data for faster decisions, streamlines regulatory tasks, and automates routine operations.

Where we stand out is in creating direct customer value. Our Personal Finance AI Assistant helps institutions deliver personalized guidance, proactive insights, and seamless support, turning digital channels into trusted advisors. The result is lower acquisition costs, stronger customer relationships, and new growth opportunities built on trust and transparency.

Common Business Cases

Client Success Stories

We have a global client base that includes Fortune 500 companies, innovative startups, and industry leaders in Information Technology, E-Commerce, Insurance, Healthcare, Finance, and Energy & Utilities.

Dramatically Reducing Customer Support Load With an In-App Conversational AI Solution

Co-Creating a Neobank From the Ground Up With a Middle Eastern Financial Innovator

Building One of the First Neobanks in the Middle East

A Future-Ready Platform Connects and Digitalizes the Precious Metal Market

Changing the World, One Socially Conscious Banking App at a Time

Disrupting the FinTech Industry With a Mobile Solution

Industry and Innovation Pulse Check

Dive into our value-adding blog pieces for technology and business insights that will complement your know-how and, occasionally, shift your perspective.

26.09.2024

AI in the Banking Sector: Risks and Challenges

22.02.2024

What is Embedded Finance – Definition Plus Examples

10.09.2024