Digital wallets began as options for simple payments in financial services. Over time, they turned into complete financial management tools as the COVID-19 pandemic unfolded. People needed safer ways to pay without contact, so digital wallets grew more common across different groups. As we examine the trajectory of these applications, it becomes evident that certain functionalities distinguish exceptional digital wallets from adequate ones.

In 2020, the global market for digital wallets was worth about $1.06 billion. It is expected to reach $4.91 billion by 2026, with an annual growth rate of 31.4%. This shows a clear change in how people handle money and points to the role of new technology in making that change happen.

This article explores the critical digital wallet features and functionalities that help providers stay competitive and meet changing user expectations. We will look at the key components that make digital finance smooth, safe, and useful. These include strong security features and easy-to-use designs that help people around the world have a better experience.

Financial management tools

Modern digital wallets do more than just handle payments. They offer full financial management features and sort expenses into clear categories like dining, transportation, and entertainment. This helps users see how they spend money in each area, set budgets for these categories and get alerts when they near their limits. Charts and graphs show financial data in an easy-to-understand way, which helps users spot trends and find ways to save money.

The features of digital wallets we recommend also include bill payment reminders with automatic scheduling that help people pay on time. Tracking savings goals encourages good financial habits by showing progress. Digital wallets connect with tax systems to organize deductible expenses and create summary reports. They also let users capture and store receipts to reduce paper clutter and keep records for returns or business expenses. Finally, these wallets gather data from different banks and accounts. This gives users a complete picture of their assets, debts, and net worth in one place.

Source: mtractionenterprise.com

Loyalty and rewards integration

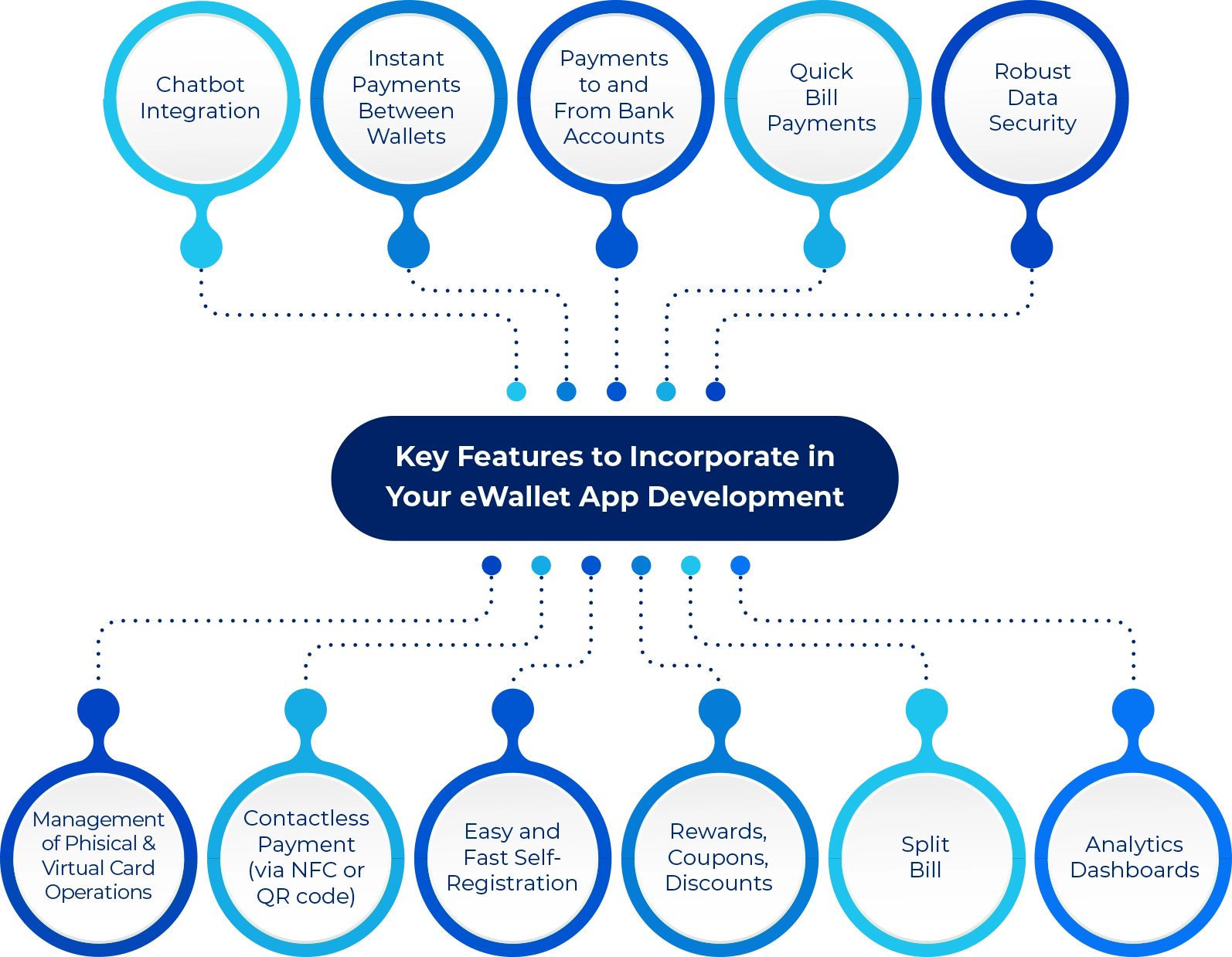

Incentive programs significantly increase the value of digital wallets. Loyalty points add up automatically when users shop at partner stores. This removes the need for physical cards and makes sure users earn rewards. Reward suggestions match users’ spending and location to help them get more benefits. Digital wallets store coupons and apply discounts at checkout without extra steps. Cashback programs give users money back on certain purchases, encouraging them to keep using the wallet. Users get timely alerts about special offers based on their preferences.

These alerts share useful deals without overwhelming users. They can exchange points from different loyalty programs to get more options and value. Digital wallets also link to travel rewards for flights, hotels, and car rentals, which lets users use them for more than just shopping. Gamification adds fun with badges, rewards, and challenges that motivate good financial habits. Partnerships with local and national merchants give exclusive deals to digital wallet users, setting digital wallets apart from other payment options. In addition, analytics tools help users see how they earn and use rewards, so they can get the most benefits.

Transaction history and analytics

Transaction monitoring gives users clear details about their finances. Users can search their transaction history and use filters to find entries by date, amount, merchant, or category. Receipts show itemized purchases and tax details to give more transparency than just the total amount. Spending tools show patterns over time and help users see how their money habits change. To complement that, summaries by merchants show how much users spend at their favorite places, while category reports reveal how money is divided across daily needs.

Companies building a digital wallet should include features that help users understand their finances. A comparison between current spending and past habits can highlight important changes. Users should be able to export their financial data in different formats so they can share it with accountants or advisors. Reports should cover daily, weekly, monthly, quarterly, or yearly periods to give users flexible options for analysis. Spending forecasts based on past data can help users plan for the future. Charts that show how quickly money is spent during billing cycles can guide users in managing their budgets more effectively. Maps that display where users spend money can offer a clear location-based view of their financial behavior. These features together give users better control and deeper insight into their money.

Payment integration capabilities

A digital wallet is useful when it works with many payment systems. It connects with major credit and debit cards like Visa, Mastercard, American Express, and Discover. This makes it easy for many people to use. It also links to bank accounts so users can send money directly without extra steps. NFC technology lets users pay by holding their device near a terminal. QR codes allow payments where NFC is not available, especially in places without this technology.

The wallet must work with popular peer-to-peer networks so people can send money directly to each other. It lets users set up regular payments for subscriptions and bills. Split payment features help divide costs among groups easily. For international users, the wallet supports payments across borders with clear exchange rates and low fees. It also works offline and updates records when the connection returns.

Security features

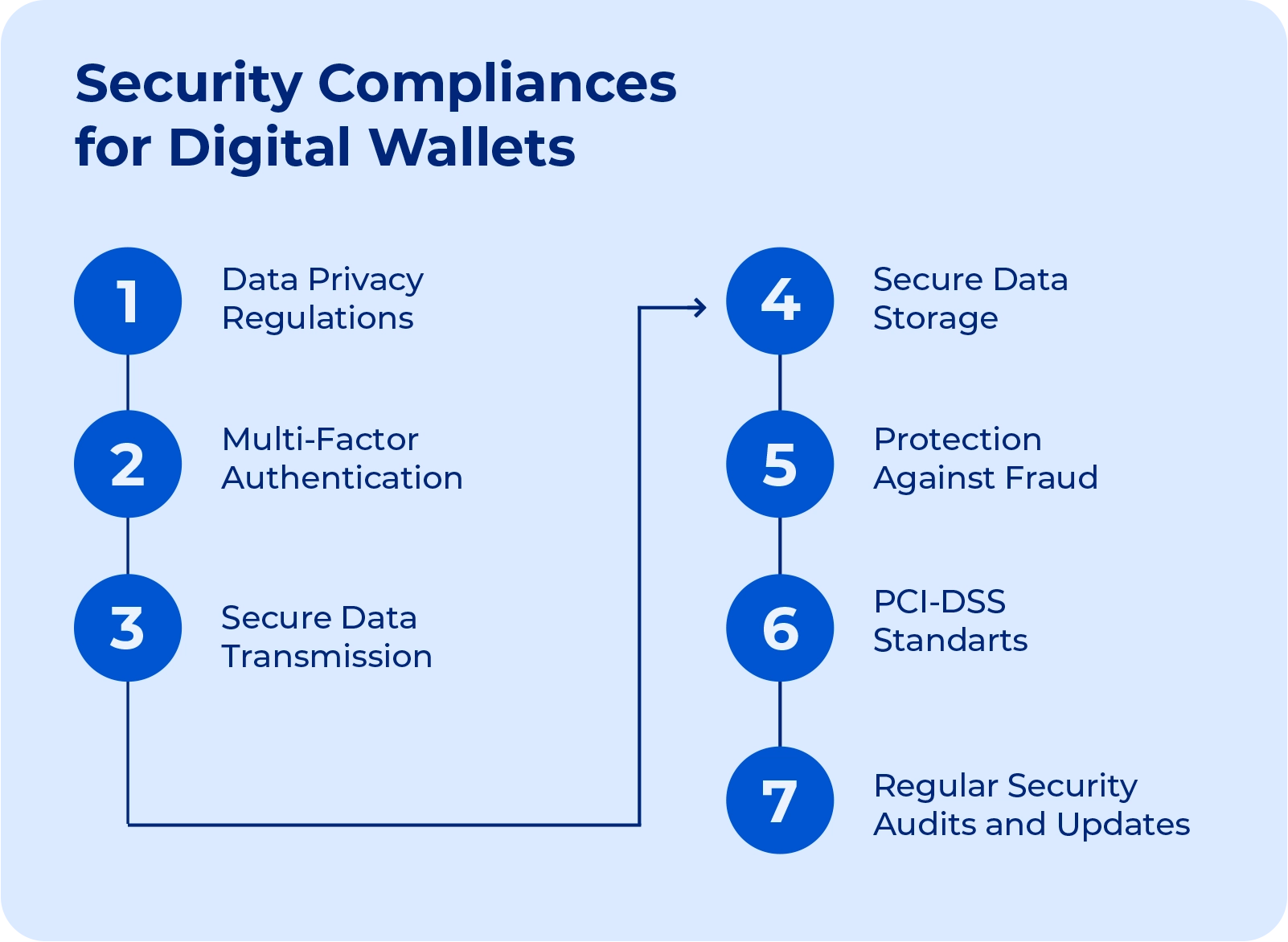

Strong security measures are the base of every successful digital wallet. Sensitive data, especially financial information, needs the highest protection. Digital wallets use advanced encryption to change sensitive data into unreadable code. This keeps data safe during storage and transfer. Two-factor authentication adds extra security by asking users to confirm their identity in two ways. This often means using a password and a mobile device or biometric data. Biometric checks like fingerprint scans, face recognition, and voice ID provide a strong defense against unauthorized access.

Tokenization swaps out actual card information with distinct codes that protect the data from exposure. If someone intercepts this data, the codes are useless to them. Biometric authentication, like fingerprint or face recognition, adds extra security by confirming that only the authorized user can open the wallet. Artificial intelligence quickly spots suspicious activity and stops fraud before it happens. Users can instantly disable their digital wallet if their device is lost or stolen. Together with automatic logout and regular security checks, these features build a strong system that protects sensitive data and keeps users confident.

Source: appinventiv.com

Peer-to-Peer (P2P) transfers

Peer-to-peer transfers are an important part of digital wallets. They allow users to send money straight to friends, family, or others. These transfers are fast and often happen instantly. People do not need to use a bank to move the money. They can send or ask for money with a phone number, an email, or a username. This makes it easy to use for everyday tasks like splitting a bill or paying someone back. Along with contactless payments, this feature adds to the convenience that users now expect from modern financial tools.

This feature is useful because people want to move money in a way that is quick, simple, and safe. Digital wallets are not just for shopping. Many people use them to manage personal payments. They may need to send rent to a roommate or share money for a group gift. Peer-to-peer transfers help them do this without delay. Without this feature, a digital wallet would not meet the needs of most users.

Interoperability and ecosystem integration

Digital wallets become far more valuable when they don’t operate in isolation. Their true potential shows up when they connect effortlessly with the services people already rely on. Whether someone is using a phone, tablet, watch, or desktop, that sense of consistency across devices makes the experience feel seamless. Add to that the ability to move effortlessly through online checkouts, and you have a tool that removes friction from everyday life.

That ease extends into the physical world, too. When wallets work with a wide range of retail point-of-sale systems, users don’t have to stress about whether something will scan or tap correctly. Connecting with banking apps lets users move money in and out of their wallet without extra steps or system switches. Some features go beyond the basics. Smart contracts handle things like payments that repeat on a schedule or only happen when certain conditions are met. There is no need to step in and manage them every time. Wallets can also make daily travel easier when they work with public transit. At work, they help keep things organized by turning scattered receipts into a clean report.

User experience design

The interface design of a digital wallet significantly influences adoption rates and user retention. An intuitive, streamlined experience begins with logical information architecture that organizes features according to frequency of use and importance. The most successful digital wallets implement minimalist designs that reduce cognitive load while maintaining comprehensive functionality.

Navigation should match common patterns so that users can find their way around easily. This helps people who are used to traditional banking systems feel more at home. The layout should highlight the most important information and actions so users know what to focus on first. Users should also be able to adjust certain parts of the interface to match what works best for them. Ideally, the app will include things like screen readers, bigger text, and high-contrast colors to make sure everyone can use it without trouble.

Conclusion

Digital wallets have grown from basic payment tools into full financial management platforms. This change proves a wider shift toward digital-first experiences. Users expect more from these wallets. To succeed, digital wallets need to offer powerful features while staying easy to use and keeping security strong.

The features described here form the base for great digital wallet experiences. The field moves fast. New technologies like decentralized finance, artificial intelligence, and augmented reality create fresh chances for growth. Companies that build or improve digital wallets must keep up with these changes and listen to what users want.

The top digital wallets become a natural part of daily routines. They simplify handling money and provide helpful advice to help users manage their finances better. When developers pay attention to security, simplicity, reliable connections, and added features, they create wallets that work well now and stay ready for a future without cash.