The way we manage money has changed fast. Digital tools now sit right beside banks in everyday life. A digital wallet lets you pay with a tap, skip the card, and move quickly. A bank account, on the other hand, does more than hold your money; it helps you save, earn, and keep things steady. Some wallets can store cash, but they don’t give you interest or offer the same protection.

Their biggest advantage, however, is that they make everyday spending easier. You can grab a coffee, split the bill, or catch a ride without pulling out your card. That kind of speed works well when you’re on the move. But when you’re handling your paycheck, saving, or keeping bills in order, a bank account does more of the heavy lifting.

The two don’t compete; they solve different problems. The key is knowing what each one is actually good for.

In this guide, we will examine the key differences between digital wallets and bank accounts and explain how to make the most of your money by using both where they work best.

Understanding the basics: digital wallets vs. bank accounts

What exactly is a digital wallet?

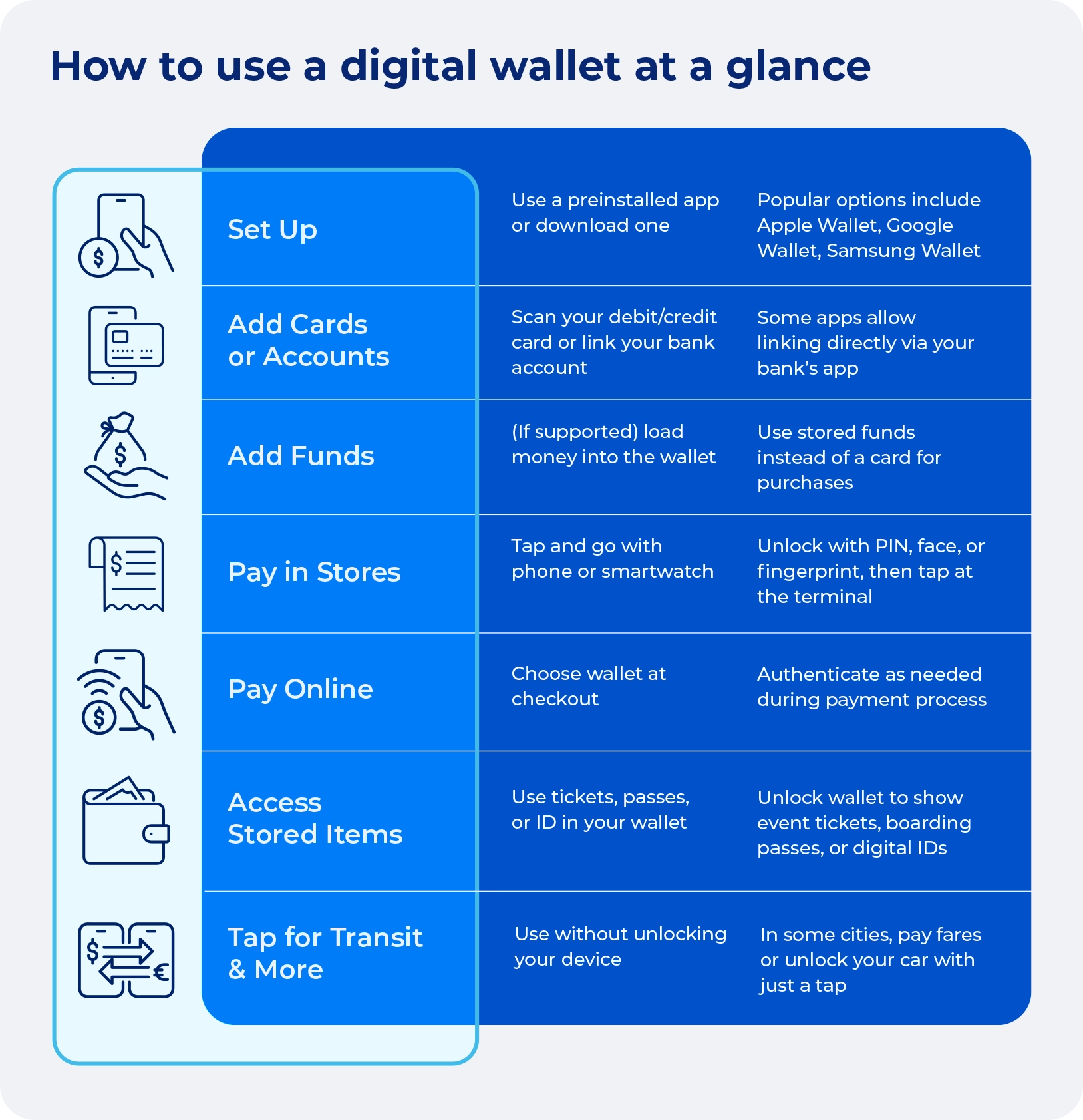

A digital wallet lets you store your card details on your phone so you can pay without using a physical card. It’s built for quick checkouts with a single tap or a scan of your device instead of swiping or using cash. Everything stays in one place, so paying in stores, mobile apps, or online is faster and easier. That’s really the point: it’s a simple way to move through your day without pulling out your actual wallet.

What is a traditional bank account?

A bank account is where you keep your money safe and easy to access whenever you need it. There are different types, like checking accounts for daily spending, savings accounts to help your money grow over time, and money market accounts that mix both.

These accounts make it simple to pay your bills, get your paycheck, and put money aside for things you want later. They help you keep track of your cash and make sure it’s protected. Having a bank account is one of the best ways to manage your money and get ready for whatever comes next.

What are the key differences between digital wallets and bank accounts?

Digital wallets and bank accounts serve distinct purposes and offer unique benefits. We’ll look at how they differ in key areas such as how your money is protected, where it can grow, ways to access funds, their primary uses, security features, and how you can use them for everyday payments. This will help you understand which option might best fit your needs and lifestyle.

Fund protection: deposit guarantee and beyond for your money

Bank accounts in Europe are protected under the EU Deposit Guarantee Schemes Directive (DGSD), which means your money is insured up to €100,000 per person, per bank if something goes wrong. That makes them a safer place for keeping bigger amounts of cash.

Digital wallets usually don’t have that kind of protection since they aren’t banks. They mostly hold smaller amounts or connect to your bank or card. Even though digital wallets have security features, it’s not the same as having that official insurance. So, if you want your money to be really safe, bank accounts are where you want to keep it.

Earning interest: where your money grows

Bank accounts often pay interest, so the money you save can grow slowly over time. Even if it’s just a small amount, that extra adds up. Digital wallets, however, usually don’t offer interest because they are meant for spending and quick access, not saving.

That means money in a digital wallet stays the same unless you move it elsewhere. If growing your savings matters, a bank account is the better choice. Digital wallets are handy for daily use but won’t help your balance increase on their own.

Accessing physical cash and checks

With a bank account, you can get cash from ATMs or use checks to pay bills and other expenses. You can take out money whenever you want, and deposits like your paycheck usually show up quickly.

Digital wallets don’t deal with cash or checks directly. They work through your bank account or card. So, you can’t get cash straight from a digital wallet. If you still use cash or checks, having a bank account is necessary. Digital wallets are useful for paying online or with your phone, but they don’t replace physical funds.

Purpose and primary use cases

Digital wallets are mainly built for convenience and speed. They let you pay quickly in stores, online, or send money to friends without cash or cards. Most people use them for everyday purchases, splitting bills, or managing small transactions. The goal is to make paying easier and more flexible, especially when you’re on the go.

Bank accounts keep your money safe and help you handle your income, pay bills, and save for bigger expenses. They cover many financial tasks, like getting your paycheck and setting up regular payments. Digital wallets are good for quick spending, but bank accounts are where you manage your money over time and plan for the future.

Security measures: a closer look at financial protection

Digital wallets keep your card details safe by using encryption and tokenization. These methods protect your financial information whenever you make a purchase, making it hard for anyone to steal your data during transactions.

Banks protect your money with the EU Deposit Guarantee Schemes Directive, which covers up to €100,000 per depositor if the bank fails, something we already touched on in the article. They also add security through tools like two-factor authentication, helping to keep your account and personal information secure from unauthorized access.

Accessibility and merchant acceptance for digital transactions

People use bank accounts through branches, ATMs, or mobile banking apps. Cards linked to these accounts work in most stores and online, though smaller businesses might not accept them or may set a minimum spend to avoid processing fees.

Digital wallets run through smartphones and are popular for quick, contactless payments. They’re handy for people without bank accounts and work well online or in modern retail setups. Still, not every store takes them, especially in areas where digital systems aren’t widely used.

Can a digital wallet replace a bank account?

A digital wallet is quick and easy to use, but it’s not meant to do everything. You won’t earn interest, and if something happens to the company behind it, your money isn’t insured like it is in a bank account. So, while wallets are useful, they’re not built to fully replace what banks offer.

The truth is, they work best together. A bank account gives you a place to hold your money, grow it a little, and take care of bills and paychecks. The wallet just makes spending smoother. When you use both, you cover more ground, you’ve got the security of a bank and the speed of a digital wallet, which makes life a lot easier for both people and businesses.

How can you maximize your financial options by leveraging both?

To make the most of both, keep your savings and paycheck in your bank account. Use it to cover big or regular expenses like rent, loan payments, or utilities. It’s reliable and keeps your money safe. Then connect your digital wallet to that account and use it for everyday things like groceries, takeout, or sending money to a friend. It’s quick, especially when you are on the go. This way, your bank account holds everything steady while your wallet handles the day-to-day. Using both together makes it easier to stay on top of your money.

How Scalefocus is shaping digital finance

With extensive experience in financial technology, we have developed deep expertise in digital wallets and fintech solutions. Our projects include building fully digital banks focused on user needs and creating digital wallets that make payments simple and secure.

This knowledge makes us a reliable partner for advancing digital wallet technology and financial services. If you’re a business looking to develop cutting-edge financial solutions or integrate digital wallet capabilities, discover how Scalefocus can help by reading How to Build a Digital Wallet in 2025.