The renewable energy sector is booming. Global investments in renewables are at an all-time high. The increase is driven by market demand and the commitments of governments, companies, and retailers to reach their net zero goals. This changes how electricity is produced and significantly impacts how energy is traded.

The rapid growth adds new layers of complexity for energy traders. The rising trade volumes and velocity of data combined with the intermittent nature of renewable sources are pushing traders to change. They are no longer just executing trades; they are starting to think more like strategic investors who need to leverage data to unlock new opportunities and mitigate risks.

To successfully operate in this new market environment, traders need more automation, market integration, and modern Energy Trading and Risk Management (ETRM) systems. A more strategic approach to data acquisition and analysis is also required. Let’s take a deeper look at how the “data storm” transforms renewable energy traders’ roles, turning them into smarter, better-informed investors.

The Rising Complexity of Renewable Energy Trading

The push to reach net-zero emissions targets puts huge pressure on energy trading companies. They must balance the drive for greener operations with the fundamental need to make profits, which creates a tricky challenge.

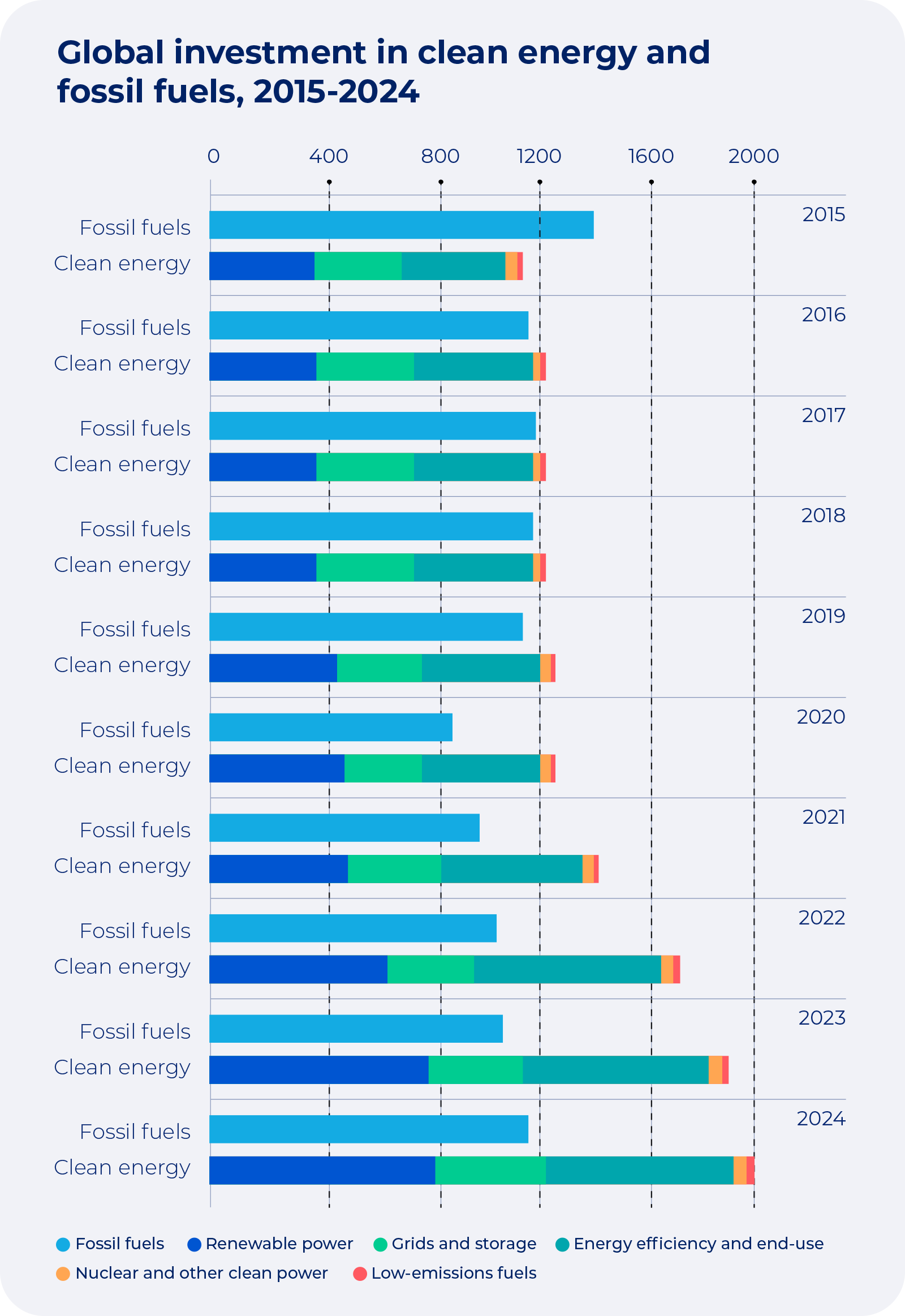

The International Energy Agency’s (IEA) latest World Energy Investment 2024 report reveals that global spending on clean energy now doubles that on fossil fuels. In 2024, worldwide energy investment is expected to top USD 3 trillion for the first time, with USD 2 trillion allocated to clean energy technologies and infrastructure.

Source: World Energy Investment 2024, IEA

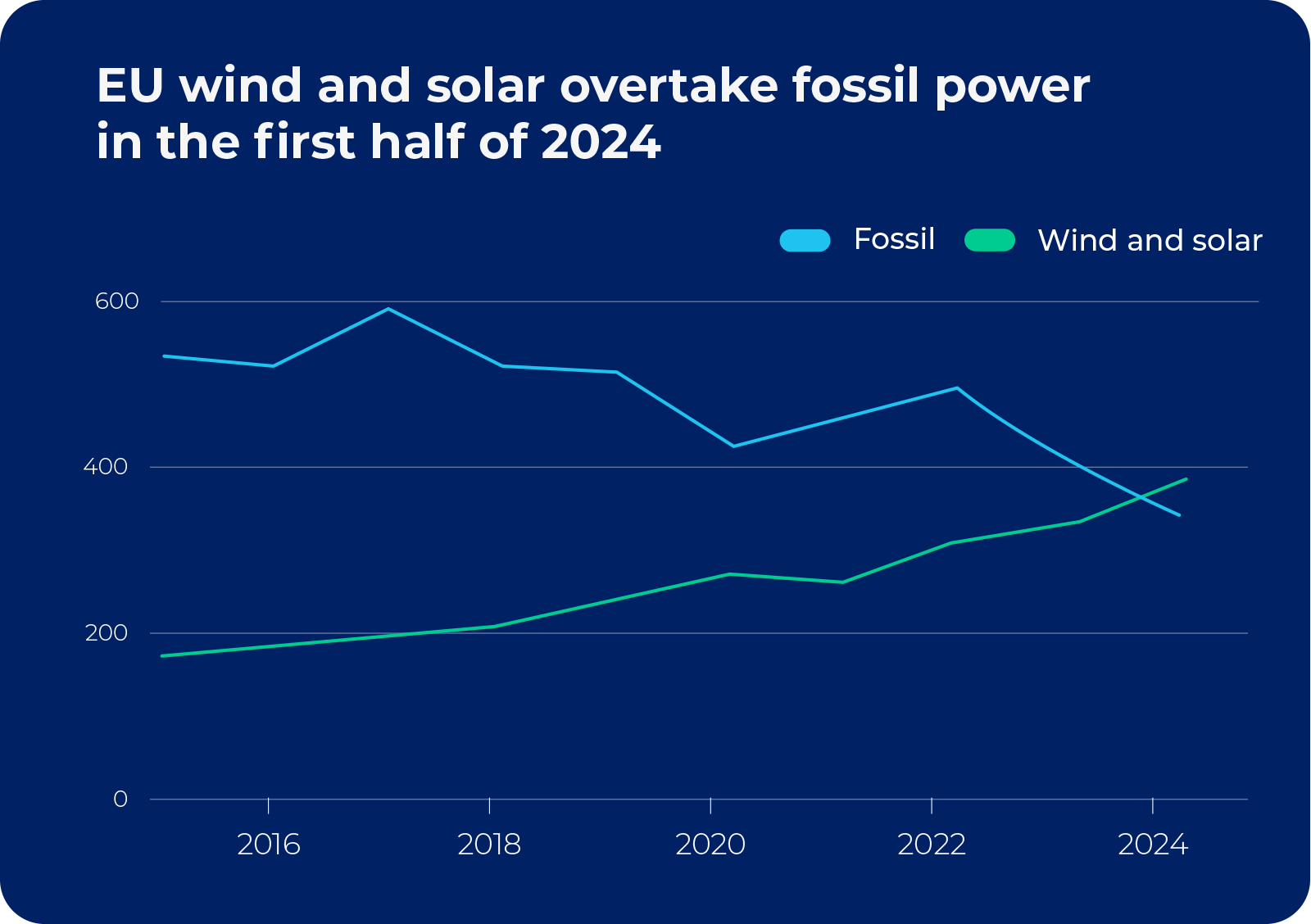

Approximately one-seventh of global energy is now sourced from renewable technologies, and almost one-third of our electricity comes from renewables. EU wind and solar energy overtook fossil power in the first half of 2024. Ember’s analysis found that Germany, Belgium, Hungary, and the Netherlands hit this milestone for the first time last year.

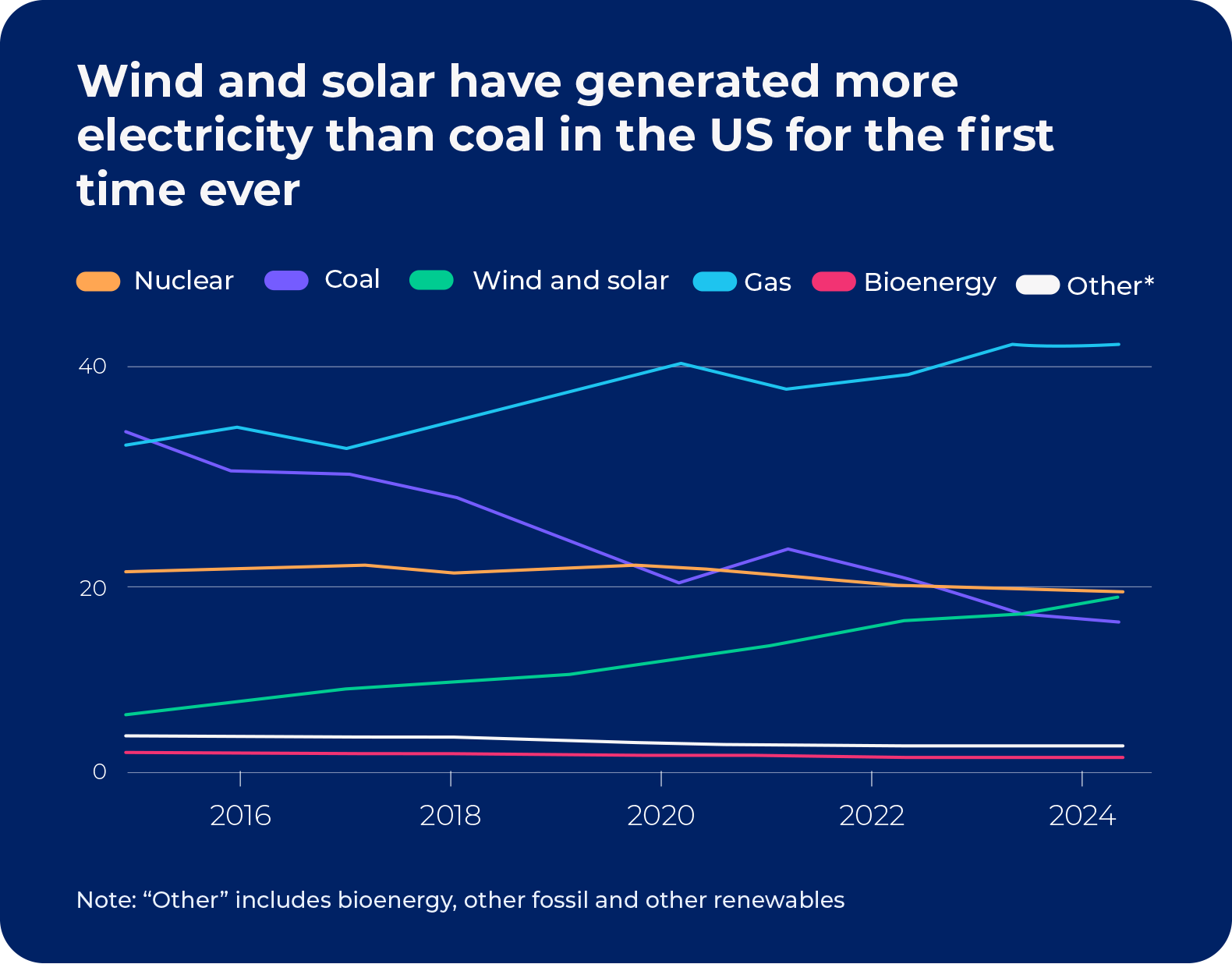

Across the Atlantic, US renewables are also pushing certain fossil fuels out of the mix. According to Ember’s data, wind and solar provided a record 17% of US electricity from January to November 2024, overtaking coal’s 15% share for the first time ever.

Unlike old-school power sources that give steady outputs green energy like wind and solar can’t be relied on all the time. Their output can lead to either an abundance of generated power at low prices (even negative when the grid can’t absorb the excess) or exactly the opposite. Figuring out how much power they’ll make depends greatly on the weather and the underlying solar or wind turbine technology, so getting the forecast right is key.

Things get trickier as we shut down more conventional technology power plants like nuclear and coal, which puts more pressure on green energy to keep the power grid stable. Managing the grid’s limits and balance becomes critically important, with network frequency and capacity playing significant roles.

The regulatory landscape is also changing fast in the EU, USA, and even the Middle East, which adds another layer of complexity to trading and investment choices. It’s clear that markets become more volatile as renewable energy sources increase. So, the strategic evaluation of green legislation, forward-generation capacity, and the risk of imbalance costs becomes pivotal.

The Data Storm: Challenges and Opportunities

The renewable energy market is flooded with data, from weather forecasts and grid conditions to energy supply and demand potential. This deluge expands as new data streams emerge from advanced technologies and new market realities. This “data storm” brings both challenges and exciting opportunities.

Traders are increasingly reliant on various disparate systems to gather and analyze key data, which leads to data silos and problems with different systems working together. These systems often can’t handle the load due to the sheer volume of transactions. Data quality and access can be spotty, complicating informed decision-making and the implementation of automated trading strategies, commonly referred to as algotrading.

The nature of data is also changing, and that’s where the opportunity comes. Traders are moving beyond traditional financial data to incorporate data from physical assets like wind turbines and solar panels. This shift requires new data processing technologies and understanding different data types, including time series, analog, and discrete data. For example, data from a wind turbine’s gearbox, which changes through different shifts, is very different from just tracking dollar value output from a wind farm. This means traders need to be able to access knowledge about the physical world and how it affects energy production in order to make ever-more effective trading decisions.

The Transformation: Traders as Smart Investors

These challenges are leading to a shift in the traders’ role. They are no longer focused only on short-term price fluctuations; they are adopting a long-term vision and are almost starting to think as co-investors in renewables. This includes:

Risk Management and Diversification: Investing in renewable energy projects becomes a smart way to manage risk, diversify portfolios, and ensure a more stable revenue stream.

Shared Goals: Traders and energy producers are finding their interests increasingly aligned. Traders have started to care more about the hands-on parts of making energy, like how long equipment lasts, resource availability, and predictive maintenance. These are the same things that energy producers have always worried about.

Optimized Energy Capacity: When trading renewables, there is a big push for profitability and longevity of the projects. Energy traders aim to feed as much data as they can into their mathematical models. This takes them out of the virtual domain of trading some kWh or GWh and financial models and puts them into the world of materials and mechanics. They want to know the durability of that solar panel or wind turbine and what part must be replaced in 5 or 10 years.

The industry is searching for its “Holy Grail” — advanced analytics systems that can predict, based on numerous variables, what would be the optimal production from renewables and how much power users will consume. They strive to determine two types of scenarios — an optimal output tier and a tier up-for-grabs, which can increase utilization and profitability. Deploying next-generation technology with state-of-the-art trading systems will help them optimize operations and make the right decisions.

Data-Driven Investment Decisions: Advanced data analysis and predictive modeling now play a key role in making smart choices about investing in renewable energy projects. When managing an energy portfolio, traders must know how to break it down, study it, and grasp its effects. They need to slice and dice the data until arriving at the right level of detail for analysis.

Traders are essentially becoming data-driven investors, leveraging their understanding of the market and their analytical skills to identify promising projects and maximize returns. They are moving beyond simply reacting to market fluctuations and are actively shaping the future of the renewable energy landscape.

Partners in Data Integration

To navigate this complex scene, companies need specialized skills and strong tech solutions. Relying on traditional end-of-day processes just doesn’t cut it anymore in the era of renewable energy and unpredictable commodity trading markets. Data’s growing volume and speed can only be effectively managed through automation and robust integration with other systems and markets.

With our deep expertise in ETRM (Energy Trading and Risk Management) software and data solutions, we help energy companies overcome the challenges of data management and integration, enabling them to make smarter, more informed decisions.

We know how crucial it is to team up with someone who can link financial and physical asset data. Our solutions focus on:

- Data Integration: Breaking down data silos and creating a unified view of the market, going through challenging tasks like timeseries forecasting.

- Holistic Market Understanding: Providing comprehensive insights into market trends, production patterns, and consumption demands.

- Integrated Platforms: Working towards the creation of a single, integrated platform that encompasses all aspects of energy production, trading, and risk management.

The data storm isn’t a threat; it’s an opportunity for growth. It impacts renewable energy traders, encouraging them to become more informed investors. It drives new ideas and accelerates the transition to a sustainable energy future. Although traders in the renewable energy market face fewer financial hurdles than producers, the process is challenging for all stakeholders. To succeed in this new age, energy companies need to use data-based answers and team up with experts who know the ins and outs of the market. The future of energy trading is smart, relies on data, and focuses on wise investments.

Reach out to discuss how Scalefocus can help you fuel your future growth in renewables trading.