(Updated 2025)

Neobanks are on the rise and this trend is going to persist. According to research, by 2025, over 80 million people in the United States will be using neobanks. From 2022 to 2025, the European market is expected to grow by 53%. The segment’s growth is due to the lack of withdrawal expenses, monthly fees, and low transaction costs.

It’s no surprise that more and more tech-savvy users around the globe are choosing to make the switch from traditional bank services. The emphasis on agility, innovation, and excellent customer experience drives users to these FinTech companies. Deciding to build a neobank in 2024, hence, seems like a smart decision.

Examples of established neobanks include Chime and N26, but newer, “nascent” neobanks are rapidly emerging globally, often with specialized services for specific demographics or regions. These may include e-commerce, immigrants, African American communities, freelancers, etc. As they develop, they may challenge traditional banking further and innovate with new financial products and services.

Every such project must start smart, too. Hopefully, you have now identified the unique banking needs of a large enough target audience. The discovery stage is crucial for ensuring your product-market fit. It’s what will help you choose the right business model that suits your business best.

Before you start: set yourself up for success

The regulatory framework operating in the financial industry is strictly designed to protect both consumers and businesses. You must research and evaluate the sets of rules in place in every country of operation. Also, users have a wide range of priorities, and you have to be aware of them.

This is how you will increase your chances of building a large enough customer base. Being profitable hinges on persuading people to switch accounts from other financial providers — you have to be fiercely competitive. Choose a highly personalized set of features that prioritize ease and speed.

In this context, we can’t underscore enough the importance of choosing the right technology partner. At Scalefocus, we have helped develop four neobanks from the ground up. We know first-hand what features are in demand and how to navigate the tech challenges of the end-to-end development process. Our team can find and fix your pain points early on, which is very important.

In this article, we are going to share the fundamentals of building a neobank from scratch in 2024. Let’s dive right in!

Starting a neobank from scratch: 8 steps and expert tips from Scalefocus

1. Choose your tech stack as early on as you can

This piece of advice is important because it will help you avoid redoing features. It’s going to ensure you use your resources the right way instead of wasting them. The finance industry is changing fast, so choose a tech stack that is flexible and scalable. You need to be able to adjust quickly once your product is out.

As your user base grows and you attract more potential customers, you will have to replace some tech ecosystem components and upgrade others. Downtime is another factor to consider. How long will it take for the update of a database or other critical elements of the app? Ultimately, a well-defined tech stack enables a frictionless customer experience.

The Scalefocus tip

Our team knows what options are available on the market, and how to choose a tech stack that will get your company ahead. We strongly recommend selecting the technologies for your mobile neo-banking app right from the MVP phase. Otherwise, you could end up managing multiple codebases and doing unnecessary rework.

Our experts will consider important factors like costs and time when making this decision. Also, review the BaaS provider’s SDKs, APIs, and documentation for quality, availability, and security. Using a BaaS provider saves time and money compared to building everything from scratch.

2. Look into different BaaS providers

Banking-as-a-Service (BaaS) platforms provide a framework that includes financial services, payments, compliance, and security. These platforms let neobanks open up their APIs for third parties to develop new services. BaaS providers’ APIs enable neobanks’ users to manage their cash flows and loans, make payments, etc.

Thus, FinTechs can focus on creating tailored financial products. Using a BaaS provider saves time and money compared to building everything from scratch.

The Scalefocus tip

Our experts will assist you every step of the way when choosing an off-the-shelf banking infrastructure. First off, we will make sure we clearly define the features and capabilities of your app. This is fundamental for picking the right provider.

Also, it’s worth considering which other financial institutions’ products are already live. Some BaaS providers lack actual implementation capabilities or can perform implementations in other regions or markets.

Next, check the BaaS provider’s SDKs, APIs, and documentation for quality and availability. Their security and performance are the other crucial factors to consider. Their security and performance are the other crucial factors to consider. To evaluate even more accurately ask for live demonstrations in real or sandbox environments.

We also suggest thinking about flexibility and customization. Ideally, the BaaS provider will allow you to customize and extend its functionality. Checking for restrictions or limitations that could impede your app’s design is also a must.

3. Develop a customer-centric mobile application

Your mobile application is a major part of your product as users want to bank from their mobile devices. It needs to offer everything from onboarding to bank account management options. This must come in a mobile solution that is as user-friendly as possible to attract the most tech-savvy customers.

The features you include will vary depending on your value proposition and your customer’s needs. However, in our experience, these are some of the most common functionalities that compelling neobanks offer: savings and checking accounts, payments, credit/debit cards, transaction history, budgeting and investing options, notifications, and real-time chat support.

The Scalefocus tip

When it comes to your mobile app, which is the face of your business, we recommend using quick prototyping. This method creates a user experience for customers. It also checks if the UI/UX is best for the intended audience.

Creating features from scratch is better than using external libraries, which could have malware. We have experience creating the core frameworks for both iOS and Android applications from scratch. If you go for the first option, make sure the third-party code comes from verified vendors and security standards meet the industry standards.

4. Ensure compliance and security

When we are talking about compliance in the context of banking, it goes hand in hand with security. This is an opportunity to get a competitive advantage over other players. However, a lot of neobanks are not directly regulated. Instead, the regulated institution is the bank that it’s partnering with.

It can be hard to keep user accounts and data safe if your partner works with untrustworthy third-party providers. That is why choosing a bank with good security practices is crucial.

On the other hand, if you do want to get your full-fledged banking licenses, be aware that regulatory frameworks vary across types of financial services and territories. Your licensing depends on your value proposition, business model, and the geographical location where you will be operating.

The Scalefocus tip

In the first case, you will be regulated by the partner bank. The financial institution you choose to work with will determine the methods for safeguarding accounts and transactions. However, your BaaS provider will be able to support you in building a great compliance practice because there are details that you will be responsible for.

For example, you need to make sure to include compliance features in your app. They will be how you adhere to regulatory requirements, such as identity verification and fraud detection.

In the second case, you need to select a technology partner with sufficient experience certifying a solution with local financial authorities and obtaining payment processing and data security certifications.

5. Build an infrastructure that supports your business model

Building a reliable and scalable neobanking app is mostly about having developers with relevant FinTech experience. Once you have obtained them and they are onboard, they will select the necessary components.

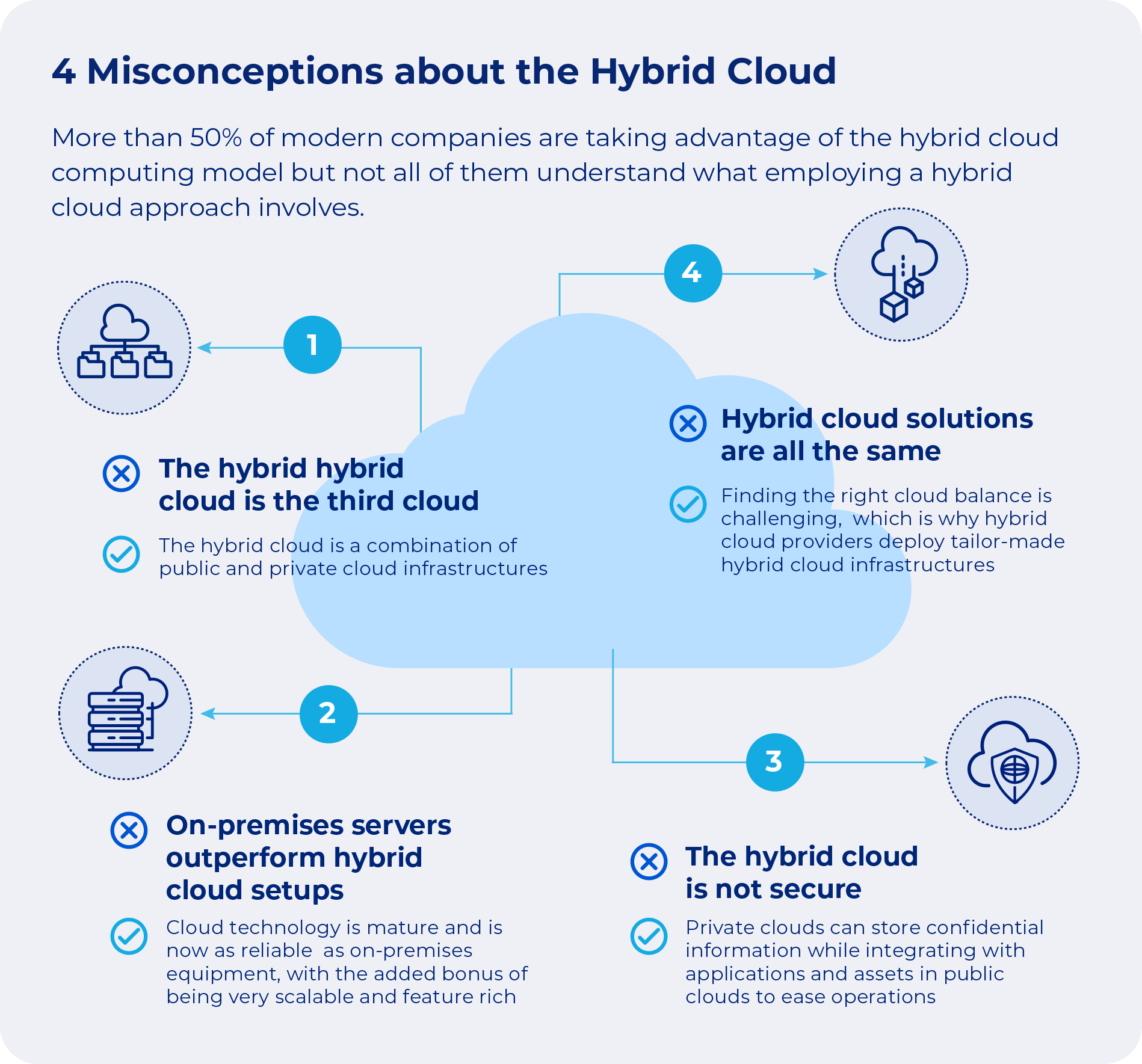

These components include backend setup, frameworks, and structure. As neobanks operate in a highly data-sensitive environment, they don’t host all services on a public cloud. Instead, most of them opt for hybrid cloud infrastructure.

Neobanks use both public and private clouds for different purposes: public for integrations and private for service development. A cloud environment helps developers create neobank platforms to improve customer experiences and provide a better platform.

Neobanks are great for groups of people who want good customer support service, lower fees, convenience, and improved digital experiences. Next, check the BaaS provider’s SDKs, APIs, and documentation for quality and availability.

The Scalefocus tip

Depending on your project’s timeline and budget, we will select the best backend tech stack for your product. We will also consider its specifications, such as its type, complexity, size, and business goal. The neobanks we have helped develop relied on hybrid-cloud infrastructure as it allows for unmatched resilience and agility.

It provides an agile environment to create, test, deploy, and cancel services within short timeframes. We recommend this infrastructure type because it combines the security of an on-premises server with the benefits of public clouds.

Additionally, internal processes should not be left behind. Setting and documenting the procedures and SLAs might seem tedious, but once your neobank is live, it will surely spare you the imminent conundrums when scaling it.

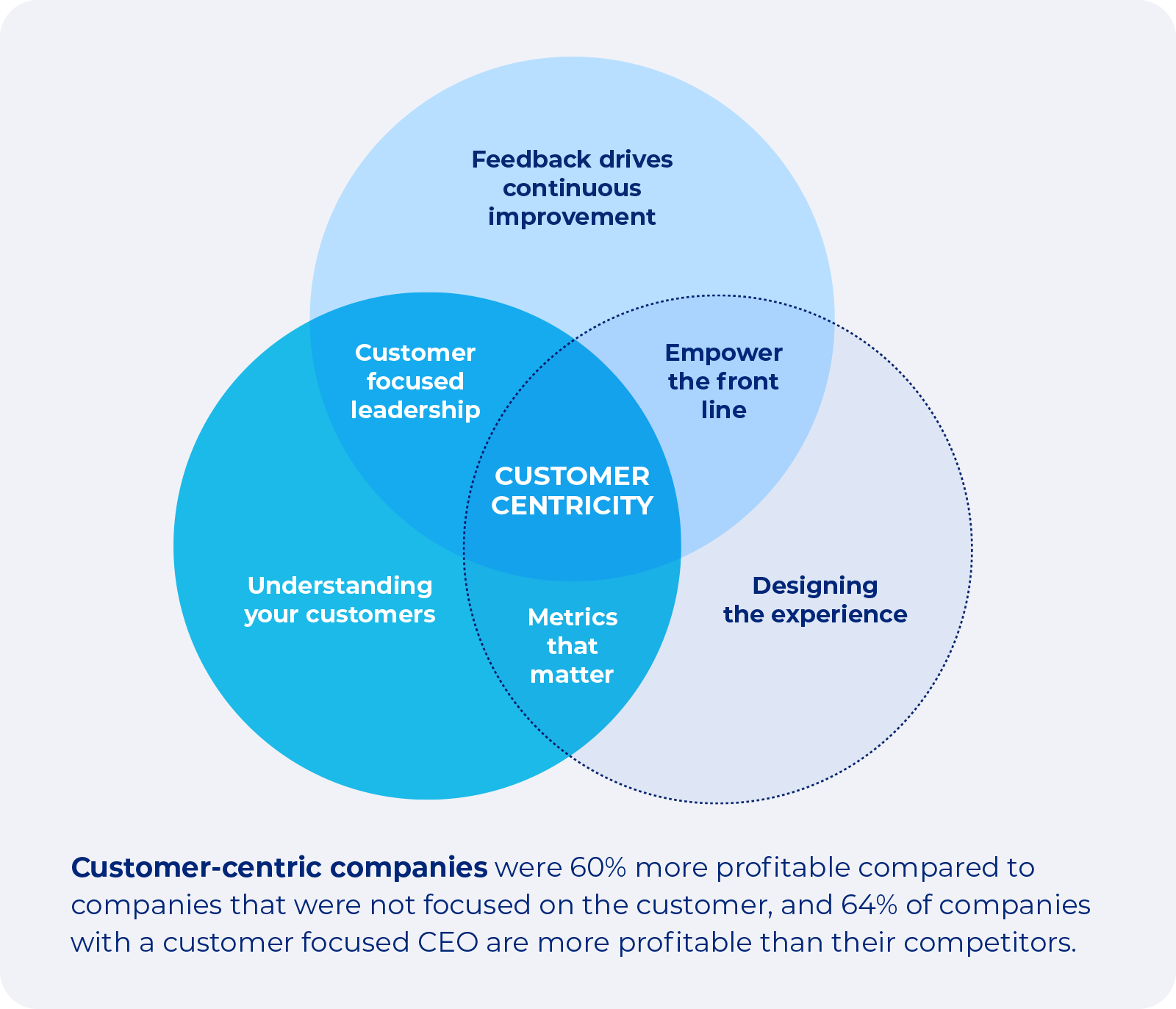

6. Think customer-centricity when it comes to strategy

Strategically speaking, this is not simply a step in your development process. Instead, it’s a 24/7 journey. Innovation is synonymous with neobanking solutions and new players must be aware of that. Growth is crucial in this small and highly saturated market. Start with customer-centricity and build your marketing strategy around it, too.

Also, innovative customer-centric solutions mean venture capitalists will get faster returns on their investments. The more innovation-proof your features are, the bigger the sustainability of your entire neobanking offering. The most reliable way to achieve this is by putting customer needs first instead of simply using customer-centricity as a buzzword.

The Scalefocus tip

At Scalefocus, we understand customer-centricity better than most technology companies partnering with neobanks. In our experience, FinTech players must focus on four distinct customer needs and build on them.

These are (1) the need to pay an individual or a company — payments; (2) the need to get funds — credit; (3) the need to grow the funds they already have — investment; (4) the need for insights to improve their finances — financial input. You must center your product around the first 3 needs. The fourth one should use data from them and provide suggestions on how customers can optimally manage their money.

7. Turn your design into an extension of your excellent product

If a customer’s banking app makes them reluctant instead of eager to use it, its design is poor. The desired outcome is simplified transactions, not confusion. The next logical question would be if there is a formula for the perfect app design. The short answer is: no.

However, creating a high-quality user experience is not rocket science. The general style of the app is crucial, and it’s composed of all elements, such as fonts, colors, etc. At its core, good UX/UI creates trust and builds confidence in your product.

This method creates a user experience for customers. It also checks if the UI/UX is suitable for the target users. Our experience has shown that simple design is a key feature of neobanking. You must stay up-to-date with trends and find new ways to create interfaces that meet users’ changing needs.

The Scalefocus tip

What we strongly recommend you focus on, apart from minimalism, is personalization. It is the game changer when it comes to building customer loyalty. Based on data analytics and insights, such as transaction history, location, and others, designers can create personalized experiences.

Another aspect of your approach should be ensuring important information is at the user’s fingertips. Additionally, avoid traditional authentication methods like passwords or one-time codes. Instead, utilize biometric authentication and digital signatures. That is how you will make the onboarding fast and secure.

8. Test and deploy

This step is all about making sure the platform is stable, secure, and fully functional. To get there, you’ll need to test its performance, security, and overall user experience. Start with a mix of automated and manual tests focused on the core features, which help catch bugs and ensure everything works smoothly across different devices and operating systems.

The Scalefocus tip

You must also conduct rigorous security testing to prevent vulnerabilities, data breaches, and unauthorized access. Once you complete the tests, plan a staged deployment with limited access to real users (beta testing).

This will get you critical feedback and help resolve any last-minute issues. After beta testing, you can proceed with the full launch. Don’t forget to monitor closely for any post-deployment issues to ensure a smooth user experience.

Top 5 challenges of developing a neobank

1. Navigating complex regulatory compliance

If you want to build a neobank, the most important challenge you need to overcome is understanding regulatory requirements and compliance. Start by obtaining the necessary licenses: this is essential. Most jurisdictions mandate that neobanks secure specific licenses to operate legally, a process that can be both lengthy and complex. You have to be prepared to fill out extensive documentation and undergo a multitude of compliance checks. Additionally, neobanks must adhere to laws such as the Truth in Lending Act (TILA) in the U.S., which requires them to provide clear information about their services to protect consumers’ interests.

There are several strategies that can help you navigate this regulatory landscape. Consulting with legal experts who specialize in financial regulations is a wise first step. These professionals can offer invaluable guidance on compliance issues unique to neobanks. The best way to ensure consistent compliance with regulatory requirements is to incorporate compliance features like identity verification and anti-money laundering (AML) measures directly into the banking app from the beginning.

2. Building a robust technological infrastructure

Your technological infrastructure needs to be sophisticated. Every successful neobank has invested in a solid front-end user interface and a reliable back-end system capable of securely managing transactions and data storage. Since neobanks must connect seamlessly with payment gateways, effective API integration is crucial. It also plays a role in fraud detection and other essential services.

Scalability is something new and up-and-coming neobanks must always keep in mind. The architecture needs to be adaptable to handle increasing demands without compromising performance. As the user base grows, the technology will have to scale effectively and quickly.

When developing the technology stack for your neobank, it is important to choose the right architecture. For example, the microservices approach allows for modular development and easier integration of new features. In the process, you must always prioritize security. Robust measures like encryption and multi-factor authentication not only protect user data but also foster trust among customers.

3. Ensuring data security and privacy

Neobanks are often targets for cyberattacks. They handle sensitive information, and they must protect it. Data breaches can cause financial losses and reputational damage, and only strong security measures can prevent them. Thanks to compliance requirements, these incidents are also preventable. For example, GDPR in Europe outlines strict guidelines for handling personal data.

Neobanks can enhance data security by taking a few important steps. They can set up a Security Operations Center (SOC) to monitor systems and detect vulnerabilities. This allows for quick incident response. Regular security audits are also important because they help identify weaknesses and confirm that systems meet regulatory standards. These steps build a safe and trustworthy digital banking environment.

4. Delivering exceptional customer experience

Neobanking is extremely competitive, and great customer experience is essential. It’s the only way to stand out from traditional and digital banks. Always remember that users expect simple interfaces, smooth transactions, and quick support. That is why investing in user-centered design is key. A well-designed app can boost customer satisfaction and encourage loyalty.

In addition, neobanks must provide multi-channel support, like chat, email, and phone. This will ensure that users can get the help they need 24/7. Another important aspect of customer experience is personalization. In this context, data analytics can help you offer services and recommendations based on user behaviors. Collecting feedback frequently is another tool that helps neobanks make ongoing improvements in their services.

5. Securing funding and financial resources

Many neobanks struggle to secure adequate funding, and this is often their biggest challenge. They need a substantial initial investment to build their foundational platform, meet regulatory requirements, and organize their marketing campaigns. Many neobanks rely on venture capital to fund their early operations. In order to attract investors, neobanks need to have a strong business model and a clear growth strategy.

On top of that, there are plenty of operational costs that they need to cover to ensure long-term sustainability. The only way to improve their chances of securing funding is to develop a solid business plan that clearly presents their value proposition, target market, and revenue model. In addition, neobanks should explore diverse funding sources, such as crowdfunding partnerships with established banks, to get additional financial support.

How Scalefocus co-developed two trailblazing neobanks in the Gulf

Helping build the first all-digital bank in the Middle East

A finance company requested our assistance in developing their advanced banking solution. This solution helps investors and traders make the most of their money using a modern digital platform. It combines the security of a local server with the benefits of public clouds.

Our development team operated with squads – cross-functional, autonomous units that focus on certain product and business goals, and chapters where specialists align on best practices, engineering standards, and solution design company wide. Project management was agile, strictly following the Scrum framework, which helped us solve challenges quickly and effectively while working with rigorous standards and quality control.

The digital bank Scalefocus co-built provides an engaging digital experience and value-adding features, such as loyalty programs and discounts through mobile. In addition to standard checking and savings accounts, transfers, and payments, it offers a holistic portfolio that includes crediting and insurance.

Co-creating a neobank from the ground up with a Middle Eastern financial innovator

Our client is a trailblazing financial institution in the Gulf working towards democratizing online banking. The company’s mission is to create connected digital experiences by taking the lead in navigating the flourishing start-up culture in the region. They set out to build a radically different bank that is app-based and designed specifically as an asset to modern customers’ daily lives.

Our track record of building banking solutions made Scalefocus the best partner in co-creating a mobile-first banking app that goes beyond the delivery of fully digital capabilities. To ensure a focus on innovation and productivity, we adopted the Spotify model to scale agile. Our experts played a leading role in certifying the solution with the local financial authorities and obtaining payment processing and data security certifications.

Amid fierce competition, our client and Scalefocus co-created a highly user-friendly digital-only banking solution in under a year. In a market that is still relatively skeptical of digital products, we helped build a customer-centric app offering personalized services that will be instrumental in the Middle East’s shift towards a digital infrastructure.

Summary

Building a neobank is no easy feat. It takes trial and error, as well as patience and hard work. There is no formula for success, but if you follow the tips we have provided, the final result will be worth it. The benefits of developing your own neobank are apparent: lower business operation costs, speed, ease of use, technology-enabled offering, and effortless international payments.

It’s the combination of basic and advanced features that will make your neobank relevant and allow it to stand out. It’s no wonder experts are deeming these FinTechs the future of finance. If you remember one thing from this, it’s to prioritize customer satisfaction and make the user experience simple and fun. Your customer will thank you for it.