In 2024, Sweden and Finland finalized their accession to NATO, a move driven by geopolitical imperatives but with ripple effects across national infrastructure, especially energy systems. For both countries, this development creates a shift in strategic priorities, with a greater focus on building integrated energy systems that share information safely and respond quickly to cyber threats.

With new operational and energy infrastructure standards emerging, Sweden and Finland must prepare for enhanced cybersecurity measures, data-driven management, and cross-border cooperation to fortify their digital and energy landscapes in alignment with the strategic goals of NATO’s energy security.

The following sections look at three key areas of the energy infrastructure likely to be influenced by NATO membership.

Defense and Energy Are Now Strategically Entwined

NATO does not impose regulatory constraints on members’ energy sectors like the European Commission does. Yet the organization articulates shared expectations: increased redundancy of critical energy systems, digital interoperability, and resilience against both physical and digital threats.

Protecting critical energy systems, including undersea networks, is high on the agenda. NATO analyzes global energy development, organizes workshops on best practices for infrastructure protection, and assists member states in improving cybersecurity. By collaborating with national authorities and various stakeholders, NATO helps to enhance the overall resilience and security of energy systems, benefiting both military and civilian needs.

As NATO membership deepens integration, obligations for energy security and resilience will cascade down to the individual companies operating at every stage of the energy supply chain. In Sweden and Finland, this chain is coordinated by national grid operators such as Svenska kraftnät, Swedegas, Fingrid and Gasgrid Finland, under the supervision of the corresponding energy ministries.

The grid operators are likely to push NATO’s expectations – redundancy, interoperability and cyber resilience down to energy producers, traders and large consumers. For example, grid operators may already require renewable plants, combined‑heat‑and‑power facilities, and data centers to adopt common protocols for monitoring, data exchange, and outage response. This is part of their existing regulatory toolkit. With Sweden and Finland now in NATO, there’s an added incentive to tighten up compliance, as these measures support alliance-wide security and resilience goals. Operators may likewise insist on redundant systems so a turbine, transformer, or compressor can keep running safely even if another component fails. Together, these steps ensure that existing rules are upheld and reinforced in line with new NATO expectations

Operational resilience should be implemented from the highest governance levels down to the equipment level. Critical machines need maintenance schedules and fallback capacity so that if one unit exceeds safe thresholds, another can seamlessly pick up the load while control systems correlate the event and maintain power quality across the network. Alongside this technical dimension comes a compliance layer: operators must document and report risk assessments, incident responses, and maintenance records to demonstrate alignment with both NATO guidelines and national security laws.

Sweden’s Energy Landscape

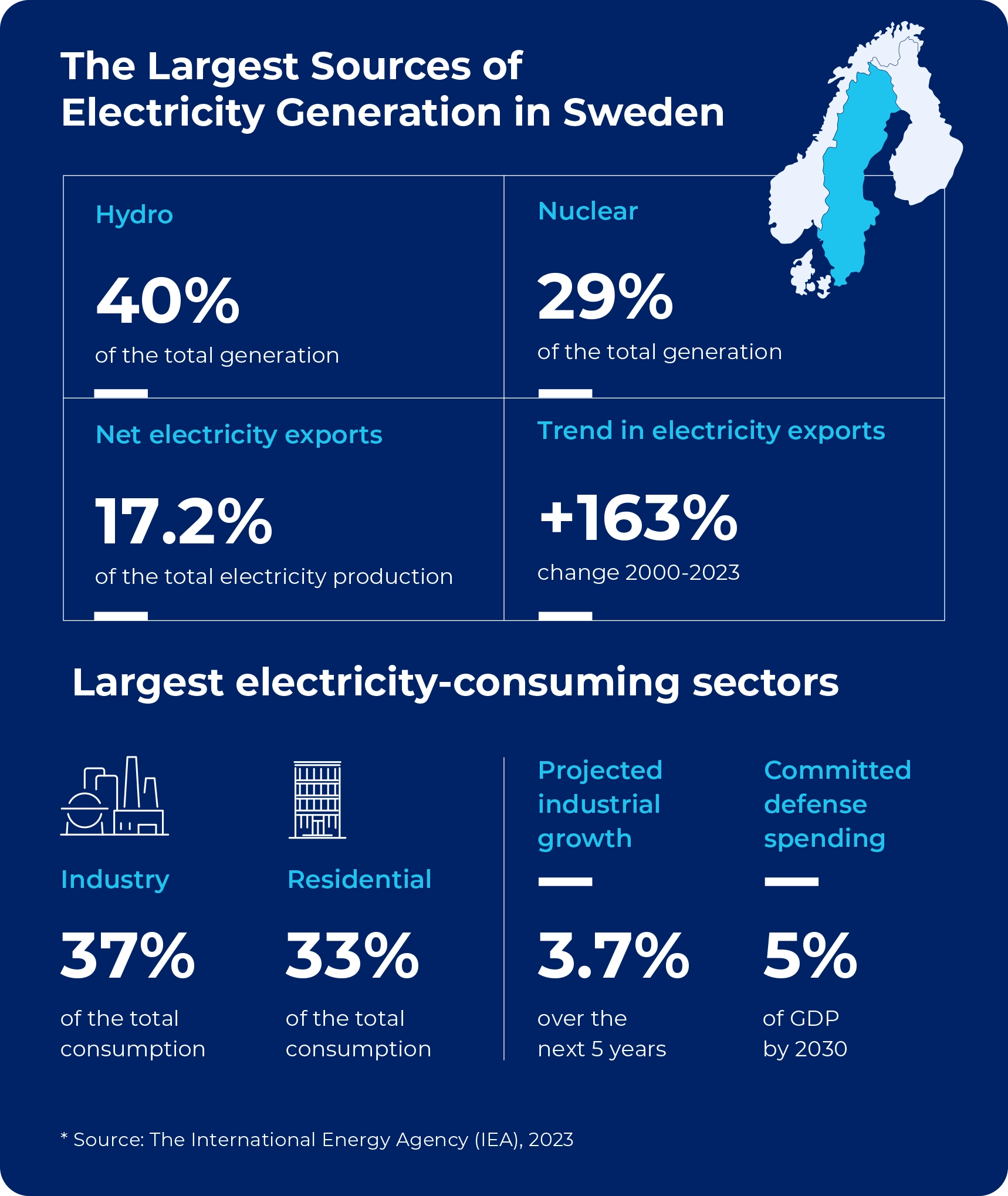

Sweden is one of the world’s most electricity-intensive countries per capita. The country is a global leader in decarbonization and aims to achieve its net-zero goals by 2045.

Sweden was the pioneer in implementing carbon pricing and currently has the highest carbon price globally, which has effectively promoted decarbonization. The nation’s energy sector distinguishes itself through extensively decarbonized power and construction industries, coupled with pioneering efforts in low-carbon heavy industry. 98% of Sweden’s electricity supply comes from renewables and nuclear.

Sweden has pledged to allocate 5% of its GDP to defense by the end of the decade, which will further increase industrial energy demand. If industrial growth continues at the current rate of 3.7% over the last five years, this would result in an additional rise of nearly 1.3% in energy consumption from the industrial sector alone. As Sweden anticipates increased electricity usage in the coming decade, it faces critical needs for streamlined transmission line planning, comprehensive system-level strategies, and coordinated grid expansion to ensure a resilient energy future.

Finland’s Energy Landscape

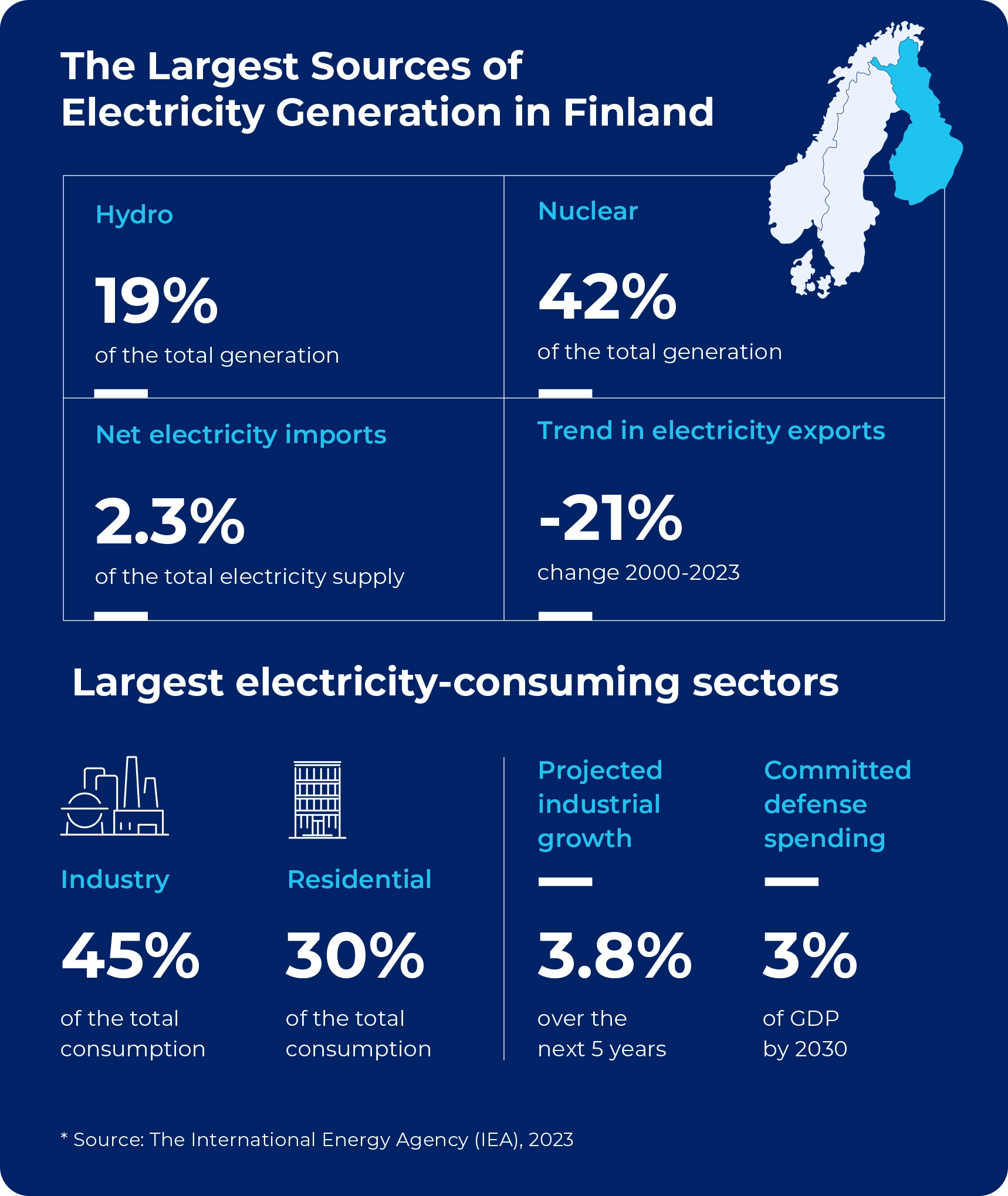

Finland has one of the most ambitious climate targets, aiming to reach carbon neutrality by 2035.

Reducing dependence on energy imports and ensuring energy security are some of the most important areas of Finland’s energy policy. The country lacks domestic sources of fossil energy and must import substantial amounts of petroleum, natural gas, and uranium. Finland recently deployed the first new nuclear reactor in Europe in over 15 years and strongly expanded wind generation. Nuclear accounts for nearly 42% of the electricity production, while renewables contribute 43%

The economy’s energy consumption per capita is very high due to the country’s relatively large heavy industry sector and the high heating demand due to its cold climate. Imported fossil fuels still account for over a third of Finland’s energy supply, and some areas of the economy, such as transport and key industrial activities, remain largely dependent on fossil fuels.

Ensuring System-Wide Redundancy and High Availability

When Sweden and Finland joined NATO, it wasn’t just about military alignment – it quietly signaled a whole new level of integration in their energy systems. Electricity grids, fuel supplies, and broader digital infrastructure in energy suddenly needed to be tougher, quicker, and smarter, ready to cope with anything from a cyber sting to a full-blown physical hit.

Both countries have advanced energy systems and are well-positioned for a sustainable energy transition, although the road ahead isn’t without hurdles. Renewables don’t always play by the rules – sunshine fades, wind drops, and that makes energy output jumpy. While solar PV installations on rooftops are increasing in both countries, their collective contribution to the national grid’s overall generation remains a small fraction. However, with time and technological feasibility, distributed electricity production will play a more significant role, putting yet another strain on the grid (from physical capacity but also a cybersecurity perspective).

Тo build a resilient power system that won’t buckle under pressure, both countries need to store more energy, use it more wisely, and upgrade their grids with smart energy technologies that can think fast and act even quicker.

Sweden and Finland must double down on the latest digital infrastructure, such as advanced grid monitoring, automated fault-detection mechanisms, and cross-border data integration. Such upgrades will truly boost their redundancy capabilities, ensuring a stable energy network that can stand tall during storms, whether digital or physical. Just precisely what NATO membership mandates.

Compatibility Demands Are Reshaping Infrastructure Planning

Finnish and Swedish energy operators must align their existing infrastructure with NATO technical standards, which presents a challenge and an opportunity to modernize. There is a considerable focus on data interoperability, which should be planned from the outset rather than added later as an afterthought.

NATO’s interoperability guidelines – such as Standardization Agreements (STANAGs) and NATO Interoperability Standards and Profiles (NISP) – were initially applied to military communication and command. Now, these protocols are also spreading to civilian infrastructure in energy transportation, electric and gas grid management, and even wind turbines.

Last year, the Swedish government rejected 13 applications for building offshore wind farms in the Baltic Sea. The decision came after the Swedish armed forces concluded that the projects would make defending NATO’s newest member difficult. The turbines were also expected to disrupt the operations of a naval radar, keeping watch over the Baltic Sea and Kaliningrad. This is yet another example of how NATO’s guidelines increasingly blur the lines between civil and military tech ecosystems.

Civilian systems that are part of the critical energy infrastructure (CEI), like energy grids or logistics networks, need to undergo rigorous data transformation and format standardization to support or interact with military infrastructure. The standardized data must flow securely and reliably even in times of crisis. CEI and operations may need to adopt military-grade cyber resilience standards to prevent vulnerabilities in dual-use networks.

Interoperability profiles define how hardware and software systems should work together. Civilian suppliers, contractors, and infrastructure owners will need to align their systems with these standards to win NATO contracts or operate in regions with NATO presence.

Handling high-volume operational data like pipeline sensor readings, smart grid telemetry, turbine SCADA signals, and early-warning systems becomes essential, especially for Nordic countries like Sweden and Finland, which depend on exposed maritime energy links.

Nordic energy grid infrastructure requires substantial reconfiguration of monitoring architectures and control protocols to enable uninterrupted information exchange between previously isolated national networks. Another strategic area worth focusing on is the LNG pipeline network. The current pipeline infrastructure between the two countries is not sufficient to meet the full energy demand of either side. As a result, they rely heavily on access to LNG terminals to secure the necessary volumes of gas needed to support both industrial operations and household consumption. This dependence needs to be rectified to ensure energy security and supply continuity during periods of increased demand or pipeline disruption.

Still, many Nordic companies are stuck dealing with outdated systems built decades ago. The modern IT energy landscape is leaving monolithic systems in the past, shifting to microservices architectures and API-driven platforms. The future requires flexible and scalable systems that can handle smart sensors and networks, spotting equipment faults before they happen using AI, machine learning, and real-time analytics. After all, keeping equipment running longer, reducing downtime, and maintaining efficiency aren’t just smart business moves – they’re essential to NATO’s vision of energy security.

Cybersecurity: The Operational Achilles Heel

With the spread of digitalization and automation, the attack surface for cyber threats widens. Both NATO allies have witnessed an increase in cyberattacks in the past two years.

In 2024, the Finnish utility company Fortum reported that it faces cyberattacks daily in its facilities in Finland and Sweden. Drones and suspicious individuals have also been spotted near its sites.

At the same time, cyberattacks on Sweden have increased by more than 300% in 2024. In June this year, the Swedish prime minister raised the alarm that, as no longer a neutral state, Sweden in NATO is now facing a wave of cyberattacks targeting key institutions. Sweden alone hosts about 57% of the region’s internet-connected industrial control systems (ICS). Conversely, Finland is becoming a primary hub for data centers with its cool climate, clean energy, abundant water resources, and well-developed digital infrastructure.

With so much critical infrastructure at stake, both countries are turning into a focal point for cyber threats. Many of these involve phishing vectors targeting SCADA systems, wind generation facilities, or attempts to breach energy trading or smart grid control platforms. At the same time, physical attacks against the Baltic subsea infrastructure have also increased dramatically.

For digital service providers, this highlights the need for zero-trust architectures, OT-aware intrusion detection, and continuous security validation mechanisms. Incident response readiness now needs to operate in hours, not days. There is a growing need to prioritize non-functional requirements like security, system performance, and reliability, as first-class concerns across the entire technology stack. Yet not all energy companies can keep pace with these pressing issues, due to legacy infrastructure, limited cybersecurity budgets, and a shortage of in-house expertise.

As threats evolve faster than internal capabilities, the resilience gap between digital-first providers and traditional energy operators continues to widen, leaving critical systems increasingly exposed to disruption or compromise. Thus, robust security measures, rigorous testing, and fallback plans must be carefully implemented, just as the technology itself.

Meeting Net Zero Goals While Defense Budgets Expand

Recently, the members of the alliance pledged to boost spending to 5% of GDP, with 3.5% allocated to core defense, such as army infrastructure and weapons. For Sweden and Finland, this commitment translates to approximately €31 billion annually, which will inevitably lead to heightened industrial activities and consequently higher energy consumption. Sweden has traditions in the military-industrial complex, and both countries are already among Europe’s top 40 defense spenders. With growing energy demands triggered by increased defense spending, the newest NATO members will need more efficiency in their energy systems and even greater investments in sustainable energy solutions, if they want to achieve their ambitious net-zero goals.

Both government and private energy companies will look for ways to work more efficiently using digital tools. Upgrades to smart grids, energy storage planning, and AI-based forecasting will be seen as a fast lane to lowering operating costs through digital transformation.

Outsourcing Realignments Open Doors in Central and Eastern Europe

With a noticeable pivot away from outsourcing hubs in Russia, Ukraine, and now increasingly Poland (due to national security perceptions), Scandinavian companies are revisiting partnerships across Central and Eastern Europe. There’s a clear desire for vendors that offer digital depth, industry expertise, flexibility, and innovation strategies.

Scalefocus, headquartered in Bulgaria, is well-positioned to meet these demands through its nearshoring delivery models and energy software services. We help energy companies eliminate data silos and inefficient workflows, establish robust security models and integrate digital energy systems where cutting-edge data streaming technologies interact seamlessly with real-time analytics platforms driven by AI. All with a delivery footprint embedded in EU and NATO jurisdictions.