It has become a given that the world of finance and technology is evolving every minute. The dynamic innovation in the industry brings along new financial products and payment methods.

One of the most significant advancements this constant shift is bringing is embedded payments. It’s an innovative concept that is transforming how businesses handle transactions by enabling seamless payment experiences. Let’s dive into its definition and unpack all the important details about this fascinating financial phenomenon.

Understanding embedded payments

Put simply, embedded payments allow users to pay for their online purchases without leaving the website or app they are using. It incorporates payment capabilities directly into the user interface, removing the need for a third-party payment processor. With embedded payments, users complete transactions with no redirection to external payment gateways for websites.

Embedded payments are often invisible to users as they are a seamless part of a platform’s user experience. They make transactions effortless — there is no need to navigate a separate payment page or enter payment details repeatedly. This enhances user satisfaction and streamlines the overall process.

The benefits of embedded payments for businesses

1. Enhanced user experience

One of the primary benefits of embedded payments is the improved user experience. By integrating payments into their platform, businesses provide a convenient payment process for their customers. Completing transactions within the platform itself eliminates the need for multiple redirects or external interfaces. This frictionless process enhances satisfaction and encourages repeat business.

By making customer experience impeccable and providing a simplified payment system, companies increase their ‘stickiness.’ It’s the factor that keeps clients using their products and services. In essence, embedded finance improves customer experience by making it smoother and by boosting its efficiency and cohesion. The whole process is more enjoyable, and users get more from the service than before.

2. Increased conversion rates

Embedded payments can significantly impact conversion rates. By removing the need to navigate to external payment gateways, businesses reduce the chances of abandoned transactions. The seamless process is a strong motivator to complete purchases that ultimately result in increased revenue.

It all boils down to efficiency. Embedded payments make buying less time-consuming and decrease the chances of frustration. Online shopping implies that your customers are seconds away from your competitors and making the experience easy and quick is a game-changer. Embedded payments can also increase both brand loyalty and customer loyalty, which is very important in highly competitive industries.

3. Streamlined operations

Integrating payments directly into a single solution streamlines business operations. With embedded payments, businesses can consolidate their payment processing and management within one platform. By centralizing payment operations, businesses can save time, reduce errors, and improve overall efficiency.

This reduces the need for manual reconciliation and simplifies financial reporting and analysis. It also removes layers of complexity by decreasing the amount of internal work an organization has to perform. Embedded finance can be an excellent tool for freeing up internal resources that a business can deploy elsewhere and a means to reduce opportunities for human error.

4. Control and customization

Embedded payments give businesses greater control and customization over their payment processes. By becoming payment facilitators, they can manage the end-to-end payment journey, from authorization to settlement. Through this control, businesses can tailor the payment journey to the specific needs of their customers and provide a consistent brand experience.

The market offers different embedded payment solutions — from plug-and-play to those with full customization options for optimal control. Your choice will impact the experience of your customers. Plug-and-play solutions are faster to implement but will most likely not address all of your and your customer’s payment needs. The other type of solution will require working with a provider to help you build a unique payment experience for your customers.

5. Additional revenue streams

Embedding payments within a platform opens up new revenue streams for businesses. By handling the payment process themselves, companies can generate revenue through transaction fees and other value-added services. For example, businesses can offer premium payment features or integrate additional financial services, such as lending or insurance, to monetize their platform even more.

When non-financial companies want financial or banking services, they usually partner with banks or other financial institutions. Such collaborations are effective but lack personalization. The financial institutions control the guidelines and the customer experiences. Businesses today use embedded payments to drive innovation and customer retention and exploit diversified revenue streams.

6. Data insights and analytics

Embedded payments are an excellent way for businesses to get more valuable data insights and analytics. They unlock a wealth of information and provide a more comprehensive understanding of customer preferences and purchasing behaviors. Companies can achieve a lot by capturing transaction data within their platform and leveraging it to personalize user experience.

Insights empower data-driven product development, optimization, and fine-tuning of offerings. By gathering information on customer behavior, fraud detection, and market preferences, businesses can make informed decisions to strengthen their market position. Another benefit is optimizing marketing strategies.

7. Improved security and compliance

With embedded payments, businesses can ensure robust security measures and compliance with industry regulations. By managing the payment process internally, companies have more control over data privacy, and fraud prevention measures. Maintaining control this way enhances users’ trust in the platform’s security practices.

Information like bank accounts, credit and debit card details is sensitive, and companies must reduce the risk of breaches or unauthorized access. Embedded payments have robust encryption protocols and tokenization techniques. They are an excellent tool for ensuring the confidentiality and integrity of payment data.

Real-life examples of embedded payments

An increasing number of successful companies are embracing embedded finance to boost user experience and achieve growth. We explore some real-life examples of businesses that have already benefited from this financial innovation.

Uber

Uber has seamlessly integrated payments into its ride-hailing platform. Users complete transactions without leaving the app, as the company stores payment details securely and automatically charges customers at the end of each ride. This frictionless experience has contributed to Uber’s success and user loyalty.

Shopify

Shopify, a leading e-commerce platform, has utilized embedded payments to enable payments from various channels, including online, in-store, and mobile. This all-in-one solution streamlines the payment process for merchants and enhances their overall e-commerce experience.

Stripe

Stripe provides embedded payment solutions for businesses of all sizes. It allows them to integrate payments into their websites or applications. Stripe’s robust API and developer-friendly tools make it possible for companies to create customized payment experiences. Embedded payments benefit brands and align with user preferences.

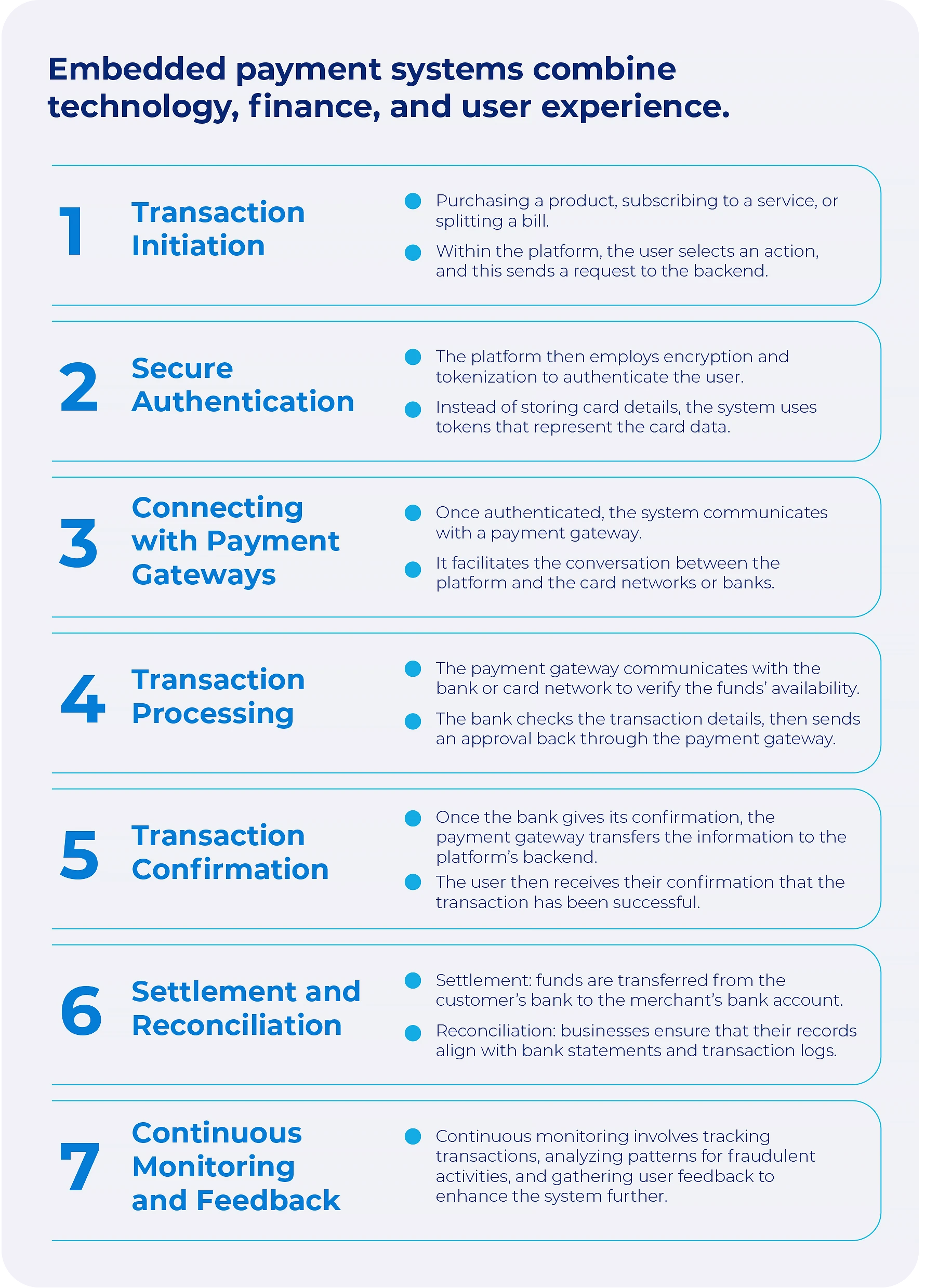

How do embedded payments work?

Embedded payments might seem straightforward on the surface but behind the scenes, there is a sophisticated, highly orchestrated network of systems and protocols.

Source: gettrx.com

Should your business use embedded finance?

Whether you use digital wallets like PayPal or offer a wide range of BNPL services, embedded payments benefit your business. Payment processing becomes more straightforward, and your brand loyalty increases while boosting conversion rates. Providing a better customer experience will boost your profit margins and remove barriers to completed transactions. Embedded payments significantly reduce abandoned shopping cart rates.

Single-click payments are the future, making the checkout process smoother and more accessible for consumers. It also increases purchase frequency. As you can see, using embedded payments in your business strategy is worth considering and will definitely add to your company’s bottom line.

Source: Vopay and Businesswire

The future of embedded payments

The future of embedded payments is promising — various industries are adopting them each day. As technology evolves, we expect to see further integration of financial services into different solutions. From business banking to lending and insurance, platforms will become one-stop destinations for all financial needs.

As the embedded finance market matures, businesses that embrace embedded payments will gain a competitive edge. By providing seamless user experience, personalized services, and new revenue streams, companies have the opportunity to position themselves as key partners for their customers.

Conclusion

The benefits of embedded payments for businesses include improved user experience, increased conversion rates, streamlined operations, and new revenue streams. In the years to come, companies that adopt them will be better positioned to thrive in the digital economy. The embedded finance market continues to grow and provides countless opportunities for better customer satisfaction and long-term business growth.