Real-time payments (RTP) represent a revolutionary shift in the payments industry, delivering instantaneous financial transactions and reshaping the traditional financial landscape.

As we delve into the world of RTP, we will explore their definition, operation, use cases, benefits, and key players. Additionally, we will look into the role of financial institutions and peer-to-peer payments. Finally, we will shine a light on the differences between RTP and faster payments before looking into future trends.

Exploring real-time payment systems

Real-time payments are financial transactions that are initiated, processed, and settled almost instantaneously. RTP networks are accessible 24/7/365 so transactions can be processed at any time, including on weekends and during holidays. Once a payment is made on such a platform, it cannot be revoked or canceled. This adds a layer of security and certainty to transactions.

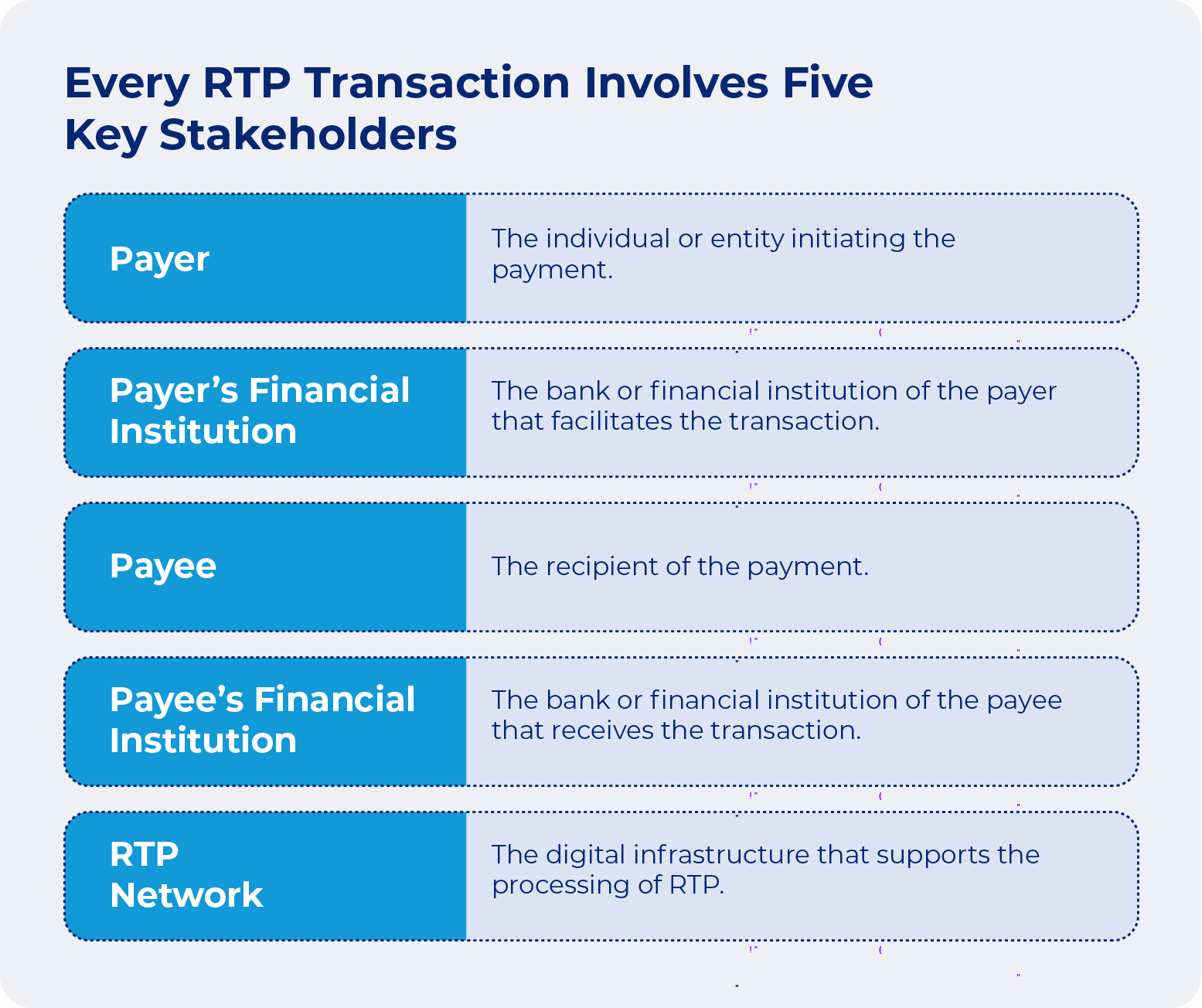

Unraveling the real-time payment process

The RTP process can be summed up in a few simple steps:

- The payer initiates a payment through their financial institution

- The payment request is sent to the RTP network

- The RTP network processes the payment and sends it to the payee’s financial institution

- The payee’s financial institution verifies the payment

- The payee’s account is credited, and the transaction is completed

Mapping global usage

Real-time payments are being used worldwide, with over 50 countries currently supporting this payment method. Many countries are adopting RTP and developing their own RTP systems to keep up with the evolving financial landscape.

Benefits of real-time payments

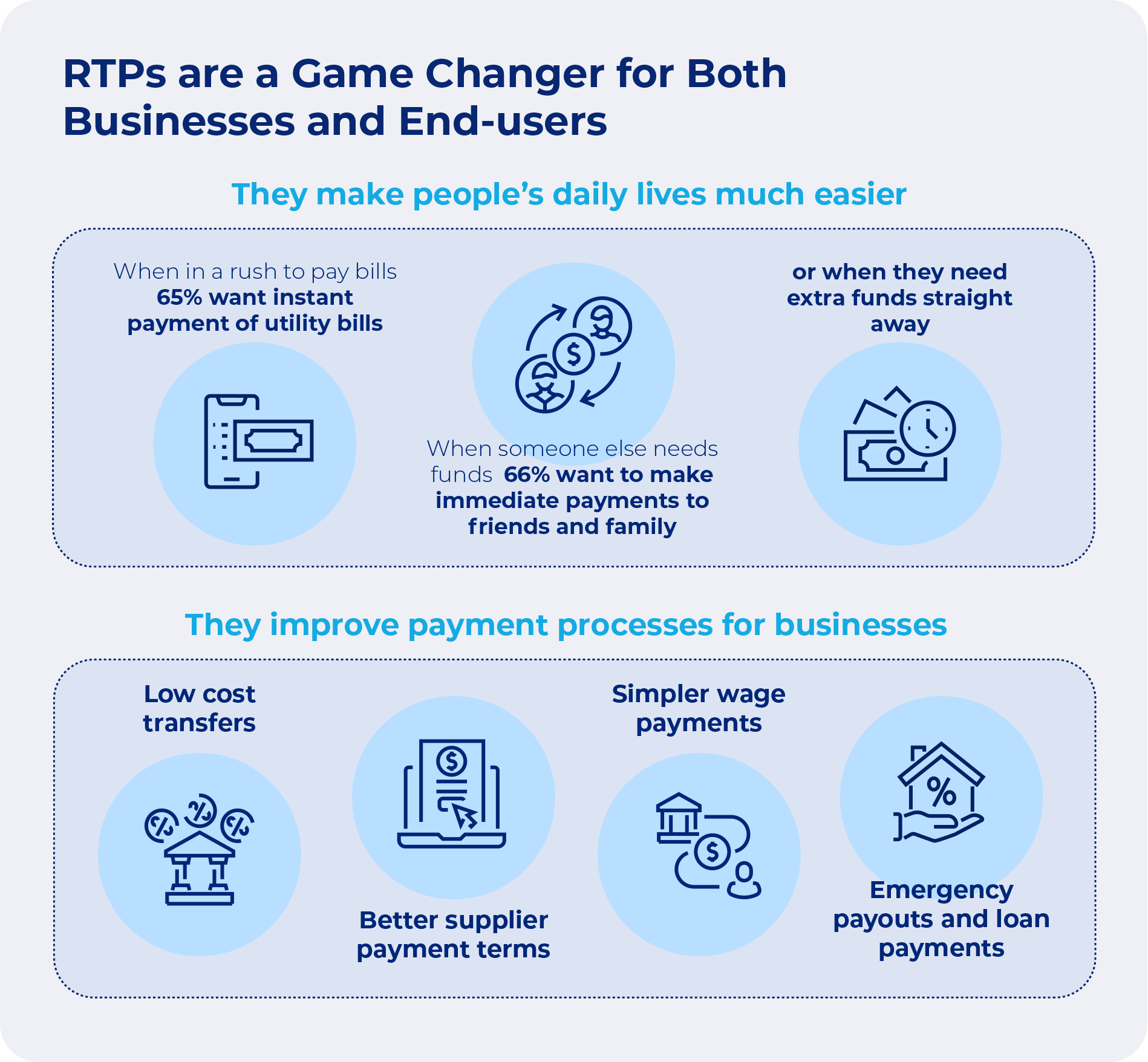

Real-time payments bring a plethora of advantages to the table. They offer instant access to funds for individuals and businesses in need of immediate financial transactions. Also, RTPs provide better visibility into financial transactions, reducing the risk of overdraft charges and other financial penalties. They bring along secure payment options, such as Request to Pay that processes payments through verified channels. Additionally, RTPs support business liquidity and cash flow management.

Source: aciworldwide.com

Driving factors

Several factors drive the growth of real-time payments. One reason is the impact of the pandemic. Another is government initiatives to decrease reliance on cash. Additionally, consumer preferences are shifting towards convenient payment methods. APIs and open banking, as well as the connectivity to new payment rails also played a significant role.

Potential use cases

Real-time payments cater to a wide array of payment dynamics and use cases. RTPs work across various scenarios: from person-to-person (P2P) payments for splitting bills to government-to-consumer (G2C) payments for disbursing pensions and social benefits. Businesses can leverage RTP for business-to-consumer (B2C) and business-to-business (B2B) payments, enhancing operational efficiency and financial management.

Differentiating RTP and faster payments

It’s imperative to distinguish real-time payments from faster payments. While both offer quicker transaction times than traditional payment methods, faster payments are not instantaneous. Faster payments can take anywhere from a few minutes to a few hours to complete, whereas real-time payments are processed almost instantaneously.

The concept of real-time ACH

Despite the similarities, real-time Automated Clearing House (ACH) payments do not exist. ACH payments are a form of faster payments, processed in batches rather than in real time. Even same-day ACH transactions take a full business day to complete, marking a significant difference from real-time payments.

Understanding the FedNow service

The Federal Reserve’s FedNow service is another key player in the real-time payments space. FedNow is an interbank real-time settlement system with integrated clearing functionality. The service is expected to launch in 2023 and will enable financial institutions to provide end-to-end faster payment services to their customers.

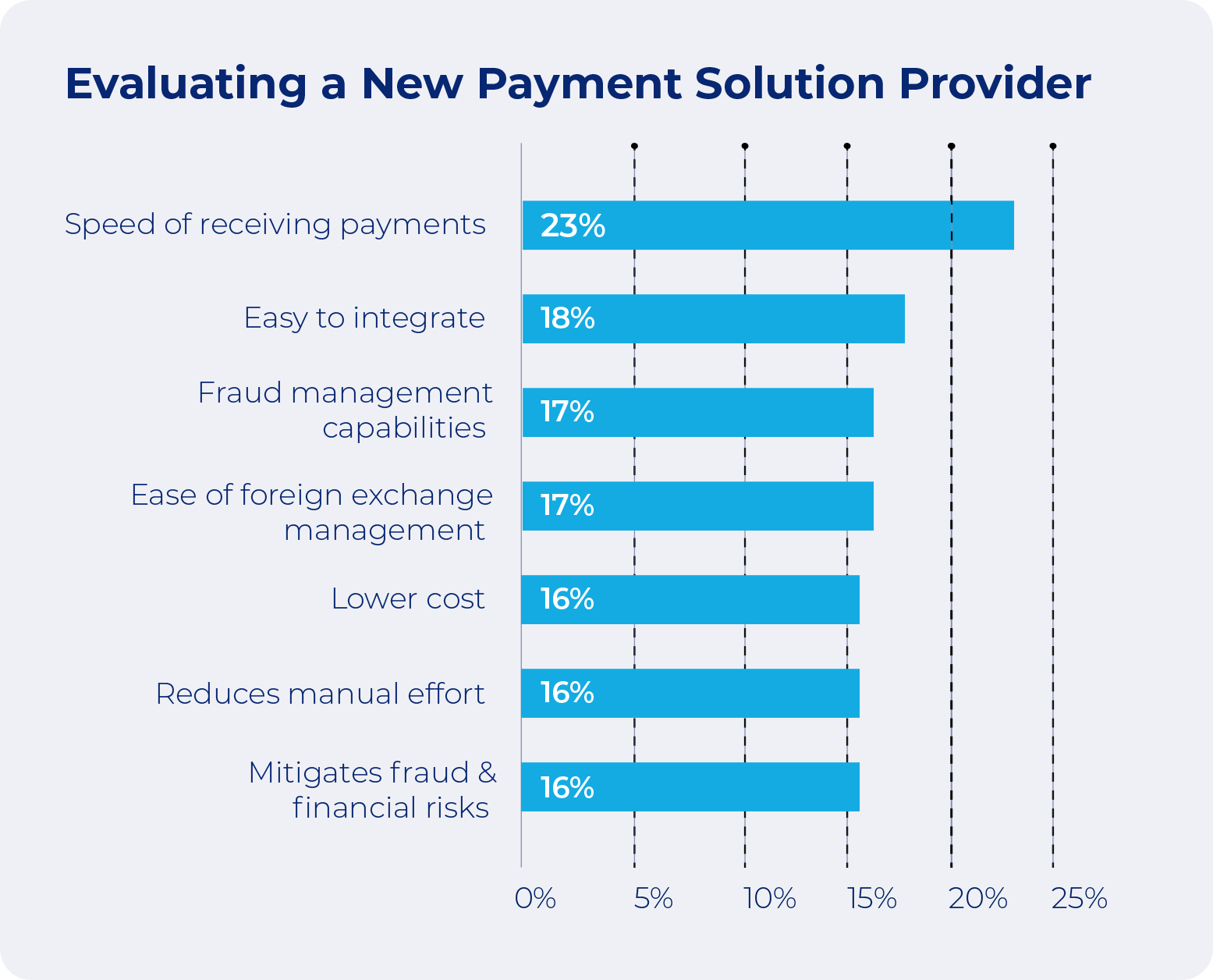

Role of technology providers

Banks interested in connecting to RTP networks often collaborate with technology providers to streamline the process. They play a crucial role in facilitating this integration, effectively enabling all banks that use these services.

Source: Cross-Border Payment Study, Rapyd, 2023

Real-time payments and peer-to-peer payment apps

Real-time payments have also found their place in peer-to-peer (P2P) payment apps like Zelle, Venmo, and PayPal. As P2P payments continue to rise, the integration of real-time payment networks with these apps is helping individuals make instant transfers, thereby replacing traditional methods like cash, checks, and IOUs.

The future of real-time payments

The future of real-time payments looks more than promising. With the launch of FedNow, the potential for further innovation and competition is increasing. As businesses, merchants, and banks recognize the value of real-time payments, adoption rates are expected to rise. This will lead to the emergence of new use cases and improved payment solutions. With real-time payments set to revolutionize the payments industry, the future of financial transactions will be instant, secure, and efficient.