In 2024, artificial intelligence and payments are closely connected. For consumers, AI reduces friction and provides advanced personalization. For businesses, it saves time and resources by redirecting human effort to truly value-adding activities.

The rise of Artificial Intelligence in digital payments

Yet Generative AI is not an overnight phenomenon. AI in banking and payments has been years in the making, dating back all the way to the 1950s. Today, AI and ML applications have become sophisticated to the point that now they support sales forecasting, customer service, human resources, accounts payable and receivable, fraud mitigation and more.

Leveraging AI has many benefits, including boosting customer support, enhancing operational efficiency, managing fraud and performing risk assessment, frictionless payment processing and authentication, among others.

In this piece, we are focusing on the most common AI use cases in payments and discussing a client success story featuring a custom-built conversational AI solution for an international financial company.

AI-powered fraud detection and prevention

AI-based fraud detection systems leverage advanced machine learning algorithms to analyze a multitude of data points, including transaction history, user behavior, and geographic location, to identify anomalies and detect fraudulent activities in real-time. By continuously learning and adapting to new fraud patterns, these AI-powered solutions can proactively protect businesses and customer data from the ever-evolving threats of financial fraud.

One of the key advantages of AI-driven fraud detection is its ability to minimize false positives, a common issue with traditional rule-based systems. By leveraging sophisticated algorithms that can discern genuine irregularities from legitimate transactions, AI-powered systems can significantly reduce the number of false declines, improving the overall customer experience and reducing the financial impact on businesses. Artificial intelligence and payment processing now go hand in hand, enhancing security even further.

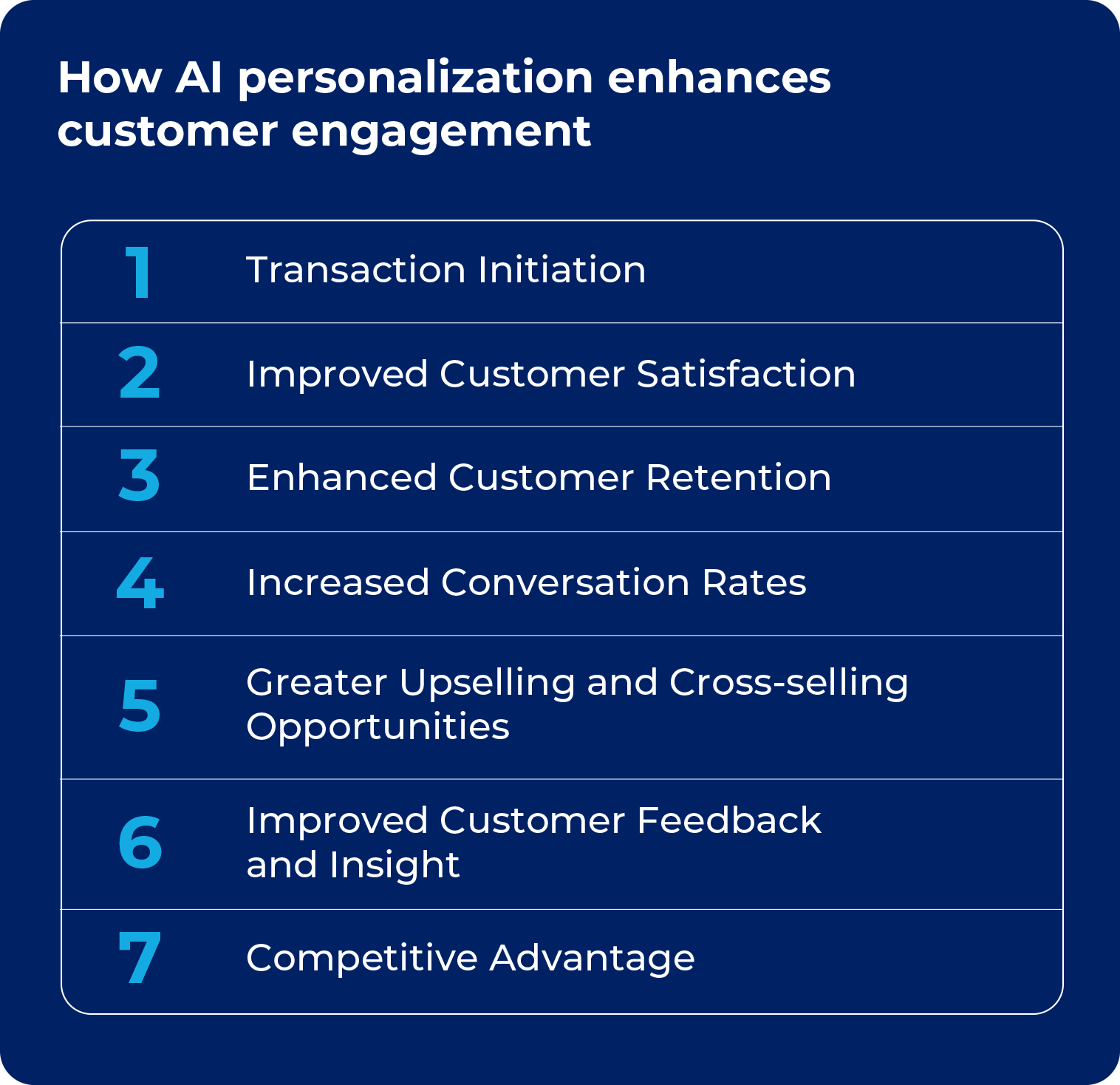

Personalized customer experience and loyalty

Artificial intelligence in the payments industry has a profound impact on customer experiences. From tailoring offers and recommendations based on individual spending habits, customized loyalty programs and rewards to streamlined payment processing and fraud detection. AI-powered solutions have the potential to transform the way customers interact with payment providers.

By delivering a frictionless, secure, and personalized payment experience, businesses can build stronger customer relationships, foster brand loyalty, and ultimately drive increased revenue and customer retention. As the digital payments industry continues to evolve, the strategic deployment of AI will be a key differentiator for businesses seeking to stay ahead of the curve.

Chatbots and conversational AI for customer support

The integration of AI-powered chatbots and virtual assistants has revolutionized customer service in the digital payments industry. These conversational AI tools can handle a wide range of customer inquiries, from payment status updates to dispute resolution, using natural language processing to understand and respond to customer queries in real-time.

By automating routine customer support tasks, AI-powered chatbots free up human agents to focus on more complex issues, leading to faster response times and improved customer satisfaction. Moreover, these AI-driven customer service solutions can continuously learn and adapt, enhancing their ability to provide personalized and efficient support.

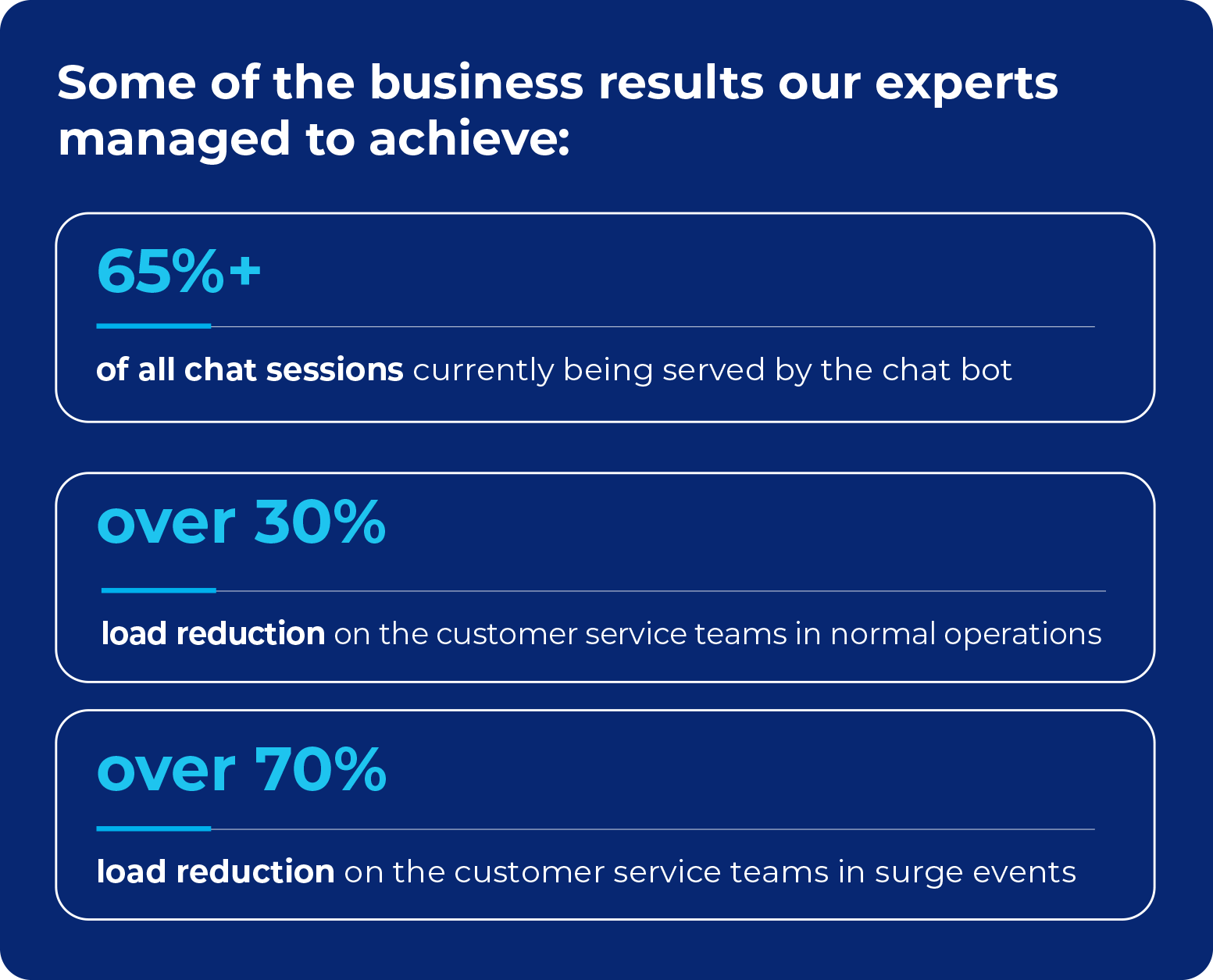

How Scalefocus helped a finance company reduce customer support load with conversational AI

The client, a fast-growing finance and investment company democratizing the financial and stock markets, wanted to provide an even better experience to a fast-growing customer base through an automated solution for their in-house support center. The Scalefocus team delivered a fully integrated custom AI solution that is now operating across the client’s in-house customer care system. It is currently handling thousands of chat sessions daily by employing a combination of cutting-edge OpenAI large language models (LLMs) and smaller fine-tuned models.

The solution is fully integrated with the client’s customer support systems and with the satisfaction rating system used for improving customer care. It frees up support agents’ time for creative solutions to non-repetitive challenges while enabling them to manage and expand the knowledge base of the solution and thus automating repetitive support scenarios and giving top customer experience at the same time.

The chatbot technology automates tasks and significantly reduces the volume of support tickets, enabling specialized individuals to focus on more complex issues and provide a higher quality of service.

You can read the full success story and learn more about this successful collaboration successfully leveraging AI in payments.

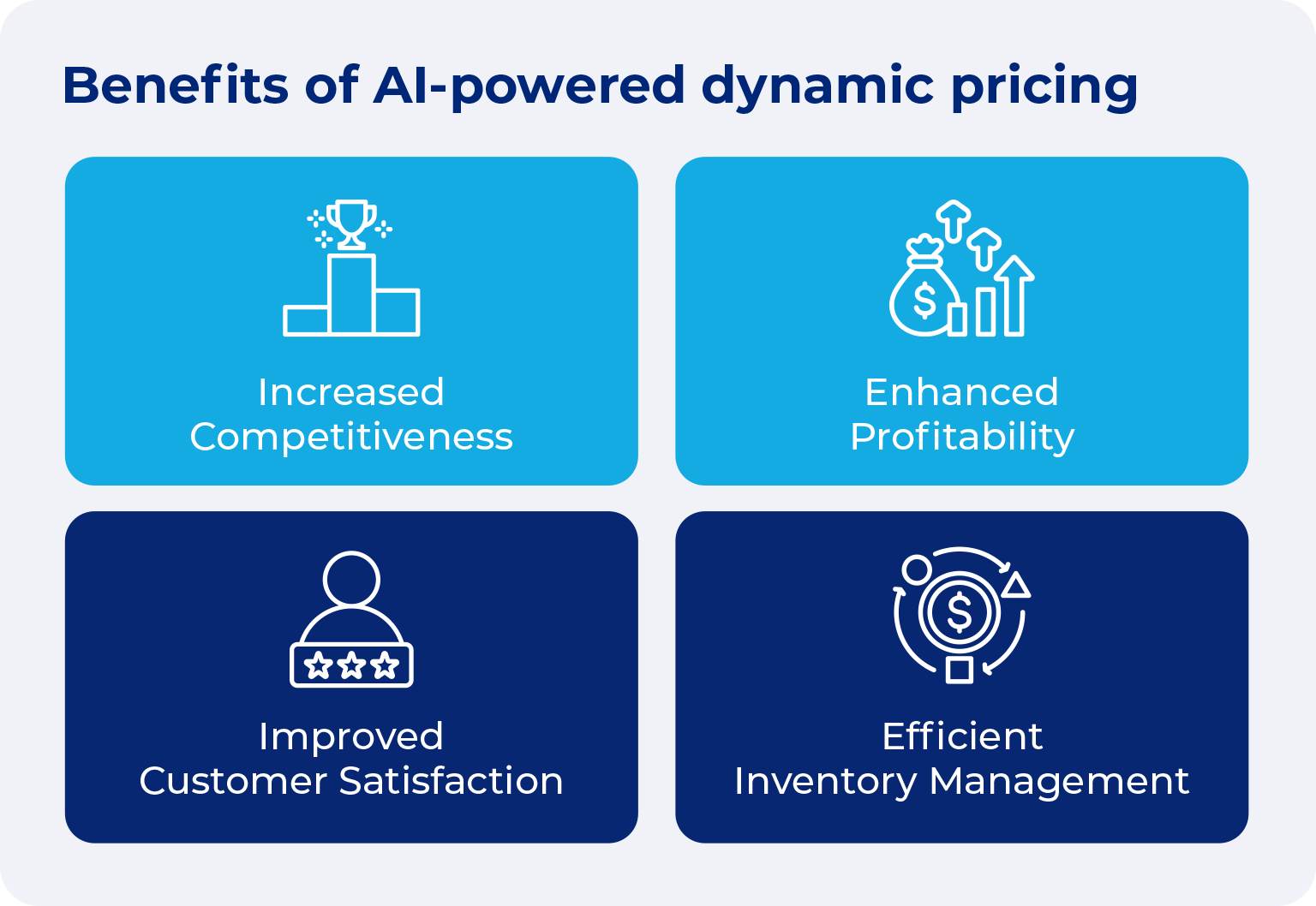

Dynamic pricing and offers

AI-driven dynamic pricing uses AI algorithms and machine learning models. To make automated pricing decisions, this technology can scan and process vast amounts of data a lot faster than any teams of humans performing data analysis could. These systems’ capacity to learn is their key advantage and their decision-making is intertwined with fast learning and accuracy progression.

They don’t simply crunch some numbers–the huge datasets they work with include market demand information, competitor pricing and other factors such as environmental events. ML’s approach involves synthesizing all of the data it has processed to constantly improve its cognitive capabilities. AI dynamic pricing models can identify patterns and trends to anticipate future changes in demand or market conditions. They adjust prices in real-time creating personalized discounts and promotions, ensuring each decision is grounded in data, rather than hunches.

Transaction processing efficiency

Today’s demands for quick and frictionless payments require exceptional agility, and AI is an invaluable tool in delivering this. Thanks to its ability to process vast datasets and automate routine tasks, AI minimizes the probability of human error and mitigates risk. It speeds up transactions through machine learning algorithms that facilitate quick authentication, considerably reducing processing times. For financial institutions, this means significant cost savings.

This increased efficiency enables organizations to redirect resources more strategically while fostering innovation. Also, AI can dramatically streamline Accounts Payable processes. It pulls information from incoming invoices and matches it to internal records. Another useful application of AI is its ability to identify accumulated bottlenecks and offer recommendations on how to adjust workflows. Thus, companies can detect any underlying issues and eliminate them early on, leading to improved operational efficiency.

The future of AI in digital payments

As the digital payments industry continues to evolve, the role of AI in payment processing will only become more prominent. Businesses that embrace AI-powered solutions will be well-positioned to gain a competitive advantage, streamlining their operations, enhancing security, and delivering exceptional customer experiences.

Looking ahead, we can expect to see further advancements in areas such as predictive analytics, intelligent automation, and conversational AI, empowering payment providers to stay ahead of emerging trends and better serve their customers.

By seamlessly integrating AI into their digital payments infrastructure, businesses can unlock new opportunities for growth and position themselves for long-term success by providing improved payment solutions.