What is BNPL?

The financial world has seen the rise of a new way to pay that is changing how people buy things — Buy Now, Pay Later. Understanding the BNPL meaning helps explain why it’s become such a major shift in online payments. As part of the broader evolution of digital payments, Buy Now, Pay Later sits alongside tools like digital wallets that redefine how people manage purchases and money online.

The idea behind BNPL is simple. You split the total cost into equal parts, pay one portion at checkout, and cover the rest over time through scheduled payments. It gives flexibility without interest charges, which makes it appealing for people who want to manage their budgets carefully. The numbers show how fast it is spreading.

Over half of American consumers have used such services. In Australia, about 10% of all online purchases are made this way. In Europe, Buy Now, Pay Later accounted for about 10% of all e-commerce payments in 2022, and the market is projected to reach roughly $293.7 billion by 2030.

For businesses, offering BNPL can make a clear difference. It helps increase sales, raise average order values, and attract more customers. Merchants working with top providers have seen their revenue rise by as much as 14% during purchases that qualify for flexible payments.

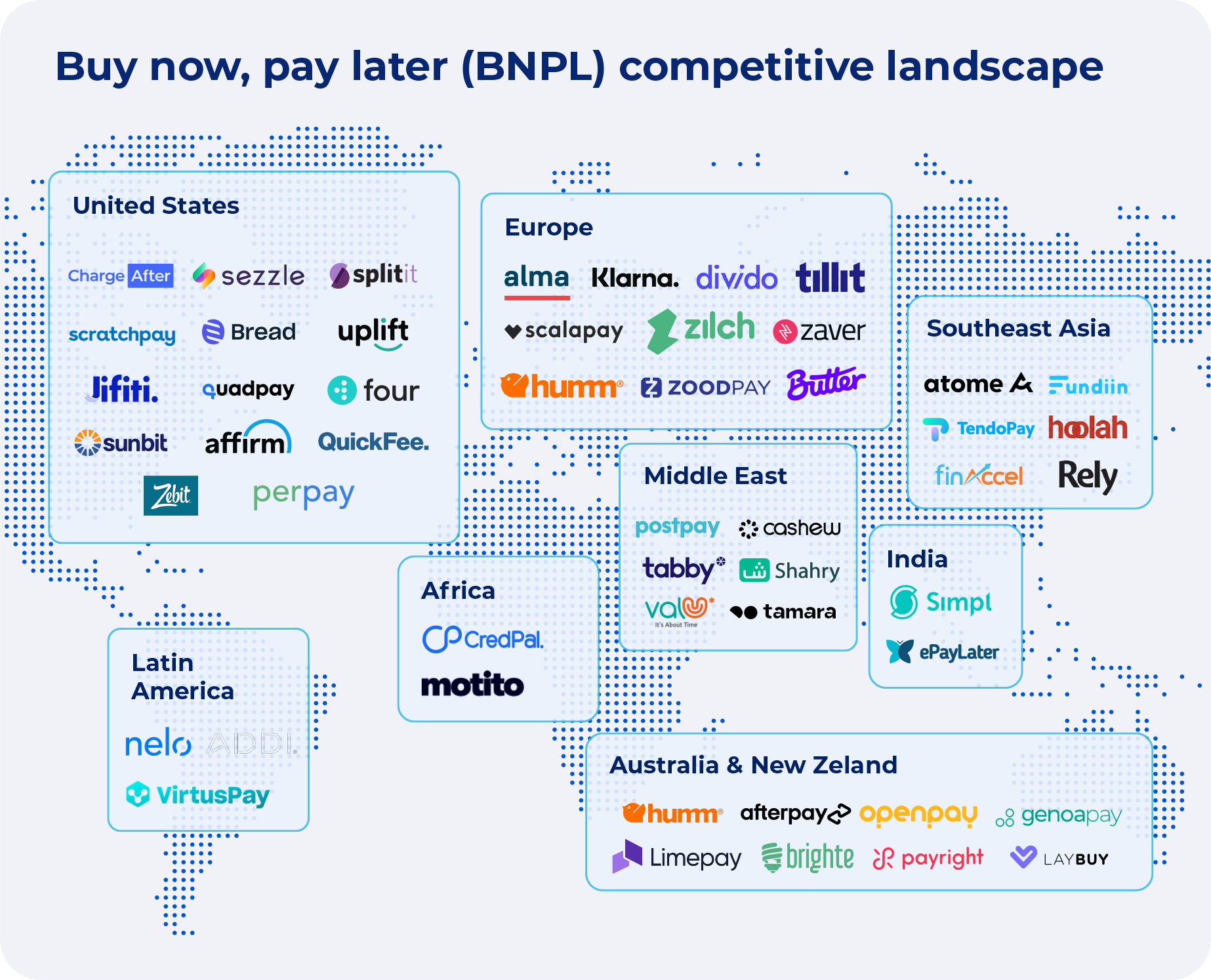

Source: cbinsights.com

Understanding the BNPL framework

The BNPL service is a way for people to buy goods without paying the full price right away. The cost is split into fixed parts that are paid over time, usually without interest. It also represents a key example of embedded lending, where credit is built directly into the shopping experience rather than being offered separately by a bank.

A $200 purchase, for example, can be divided into four interest-free installments, $50 each. The first payment is made at checkout, and the remaining payments are due every two weeks. This system is different from credit cards. Credit cards add interest when payments are delayed, while most Buy Now, Pay Later plans do not. As long as customers pay on time, there are few or no extra fees. The clear structure and low cost make these plans appealing to many users.

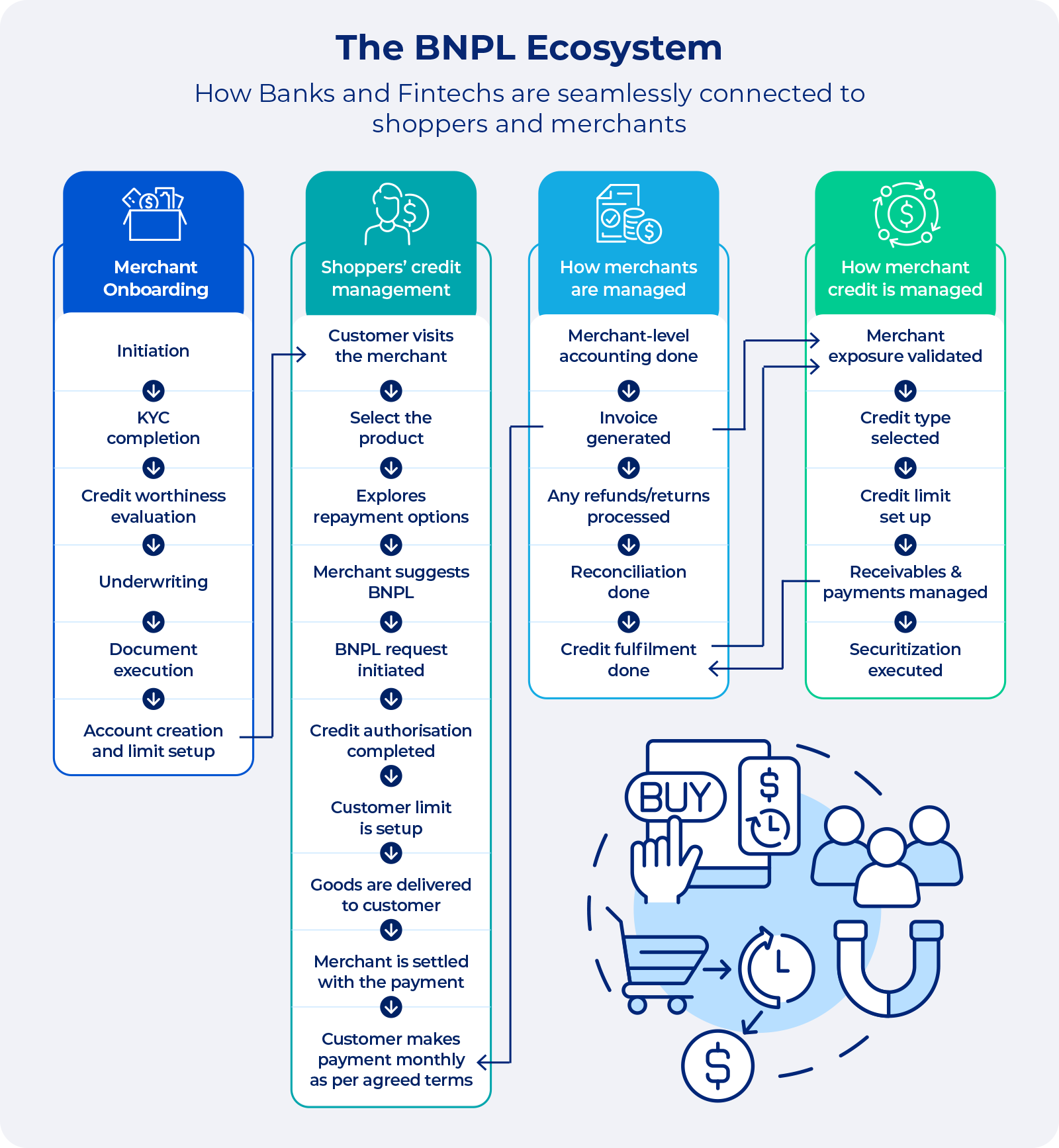

Three parties are involved in each transaction: the buyer, the seller, and the Buy Now, Pay Later provider. The provider pays the seller in full, minus a service fee, then collects the payments from the buyer. For sellers, the process is simple. They receive their money upfront, while the provider manages credit checks, payment tracking, and collections. This allows businesses to sell more and spend less time on financing tasks.

Source: aspiresys.com

Benefits for merchants

Buy Now, Pay Later for business helps companies grow and stay financially secure. It provides them with payment certainty because the provider pays the full amount upfront. The provider then collects the money from the customer over time. This process protects the business from missed payments and fraud.

These services also help companies reach more buyers. Many people prefer flexible payments instead of using credit cards. About a quarter of millennial shoppers and one in ten from Generation Z have used Buy Now, Pay Later for online purchases. Providers also promote their partner stores through online platforms and email campaigns. This exposure brings new customers to the business.

The impact is visible in sales. Flexible payment options make higher prices feel more manageable and encourage more people to buy. They often increase order size too, as customers add more items when they can pay over time.

Consumer advantages and considerations

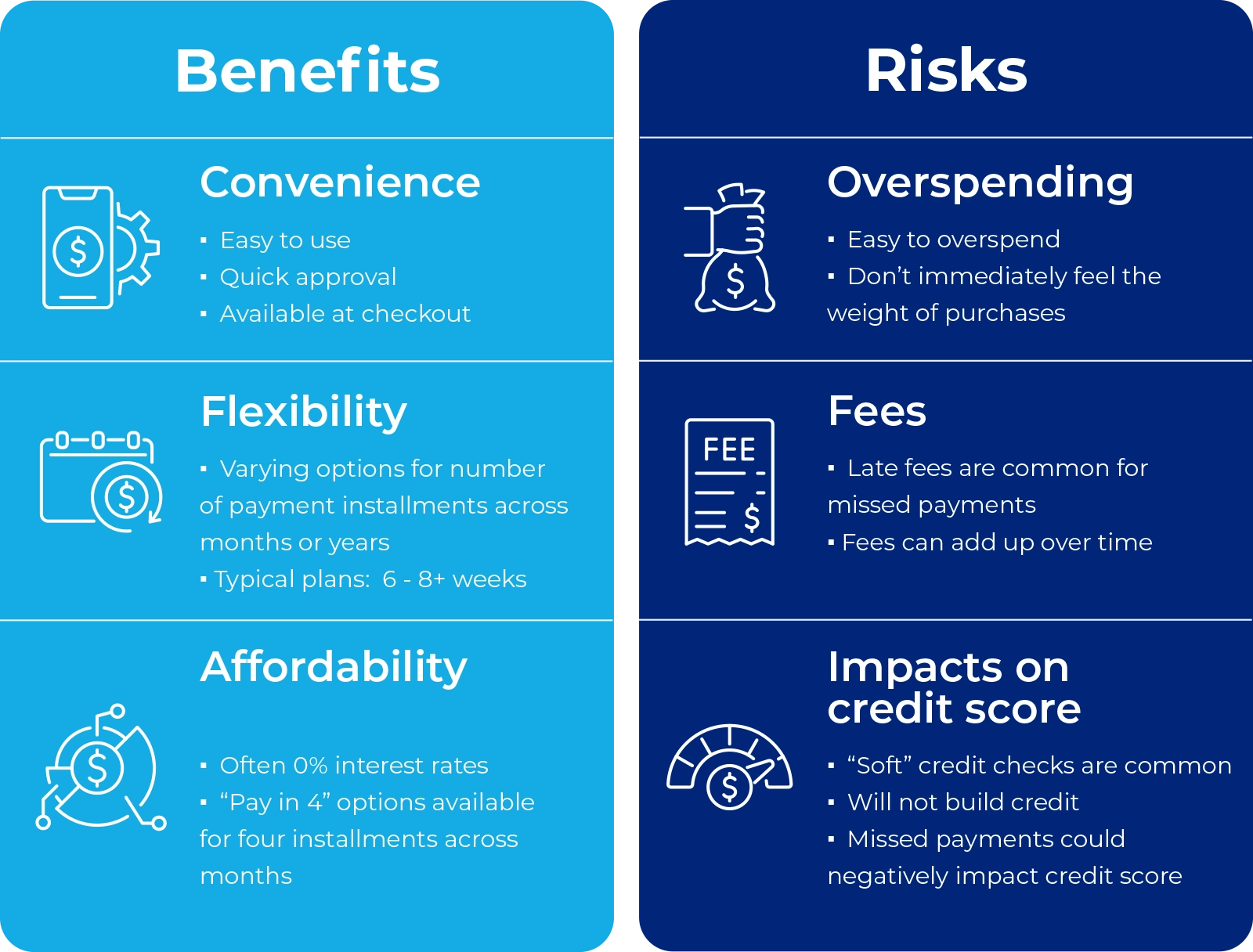

Buy Now, Pay Later services offer shoppers more flexibility than traditional payment methods. People can get what they need right away and pay for it over time with interest-free payments. This makes it easier to manage money and avoid the high interest associated with credit cards.

The process is quick and easy. Traditional financing needs long forms and strict credit checks. Buy Now, Pay Later approval takes seconds and asks for only a few details. This helps individuals with limited credit history or those who prefer not to use credit cards.

Still, it’s important to be careful. Paying in smaller parts can make a purchase look cheaper than it really is. That can lead to buying more than planned.

Fees for missed payments can also cause trouble. Most short-term plans have no interest but missing a payment can lead to fees or harm your credit score. It’s best to be sure you can make each payment before using the service.

Source: bankwithunited.com

Selecting the right BNPL provider

Businesses that want to add Buy Now, Pay Later options must consider several key factors before selecting a provider. Repayment terms are one of the most important. Each provider has different payment schedules and term lengths. Companies that sell higher-priced products may need longer repayment periods. Those who sell lower-cost items may prefer shorter cycles.

Credit limits are another critical point. Each service sets its own spending range based on customer history and internal rules. Some set minimum and maximum limits that can affect who qualifies for a purchase. Businesses should work with providers whose credit limits match the value of their usual transactions. This helps increase approval rates.

Geographic reach also matters. Not all services operate in the same markets. Some providers are strong in specific countries. Afterpay and Zip are well-known in Australia. Klarna is widely used in Germany and across the Nordic region. Companies should also consider how easy each provider is to set up, the fees they charge, and the strength of their customer support.

Implementation process

Adding Buy Now, Pay Later options to an existing payment system takes several steps. The first step is choosing the right providers. Businesses make this choice based on customer profiles, average purchase size, and target markets. Once the partners are selected, merchants complete an application that includes company and transaction details.

After approval, the technical setup begins. Some providers offer easy plugins for popular e-commerce platforms. Others provide advanced API solutions for custom systems. The time and effort required depend on the integration method and the company’s technical capacity.

Businesses that want a faster setup can work with payment processors that already support several Buy Now, Pay Later providers. These processors handle most of the technical work. Merchants can activate the service directly from their admin panel rather than developing it themselves.

Once the setup is complete, clear communication with customers is essential. Businesses should include brief explanations on product pages, shopping carts, and checkout screens. This helps customers understand how the payment option works and what advantages it offers.

Future trends

The Buy Now, Pay Later market is changing quickly, and several new trends are shaping its direction. One major trend is consolidation. Large financial institutions are buying smaller BNPL providers to add these services to their own portfolios, which could lead to more standard rules and stronger protection for consumers.

Governments are also paying closer attention. Many are creating or enforcing laws to ensure fair lending and clear information for users. These rules aim to support innovation while protecting consumers. They may also influence how providers manage their services and interact with customers.

Technology is another driving force. Artificial intelligence is also transforming BNPL by helping providers assess credit risk and tailor payment experiences, much like its role in cross-border payments. New AI and machine learning tools enable providers to assess loans more accurately and tailor their offers to meet customer needs. These tools enable faster approvals while maintaining risk control.

As the market grows, businesses must closely follow these changes. Keeping up with new trends and regulations enables companies to enhance their payment options and maintain high customer satisfaction.