Finance is undergoing a quiet revolution. Where once credit was distributed solely through banks, today loans are appearing directly inside the platforms we use every day, whether it’s a checkout page, a SaaS dashboard, or a business marketplace.

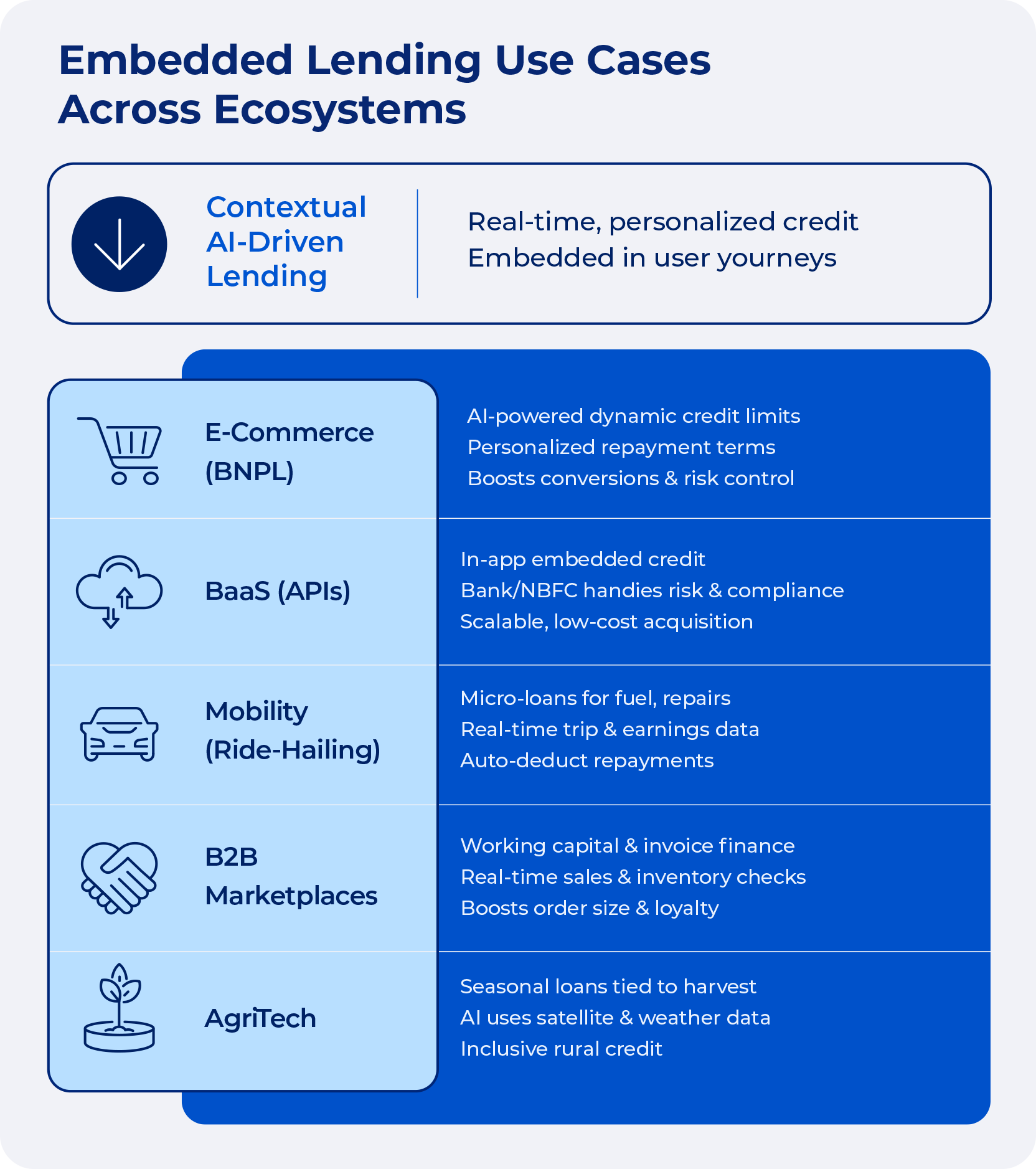

This is embedded lending, and it’s one of the fastest-growing segments of the embedded finance boom. By merging technology, data, and partnerships between platforms and lenders, embedded lending is reshaping how individuals and businesses access credit.

By 2029, embedded finance is on track to become a $385 billion market and grow at a steady rate of 30% each year. Embedded lending is the most disruptive part of this growth. The move to place financial services inside everyday digital tools is more than a technical change. It is a complete rethink of how credit works in the modern economy.

In a nutshell, embedded lending gives both businesses and consumers easier access to credit. They can stay within the platforms they already use when they need funds, often alongside embedded payments that streamline checkout. This article explains how embedded lending works, how it connects with embedded payments, and how it shapes the future of financial services.

What is embedded lending?

Embedded lending refers to the integration of credit products into non-financial platforms. Instead of going to a bank, a borrower can apply for and receive financing in the very moment they need it while managing payroll, shopping online, or booking a service.

The model works through partnerships. The platform gives the customer interface and detailed behavioral data. A licensed financial institution then provides the capital and manages underwriting. APIs and modern cloud systems connect both sides. They turn loan processes that were once complex into fast and easy experiences for users.

How embedded lending works in practice

From the user’s perspective

For the end user, the process is remarkably simple. Offers are presented contextually, for example, a Buy Now, Pay Later option at checkout, or a revenue-based loan within a small business’s accounting software. The experience feels natural, with financing appearing right at the moment it’s needed. According to RBC Capital Markets, BNPL increases average ticket size by between 30% to 50%, and retail conversion rates by 20% to 30%.

Source: RBC Capital Markets

Behind the scenes

Several steps work together to make this process possible. Platforms look at transaction history, sales volume, or subscription data to create offers and pre-qualify users. Automated systems then check risk in real time with both traditional credit data and alternative sources.

Funds can reach the borrower within hours or days. Repayment can follow fixed schedules or adjust to revenue, matching the borrower’s cash flow. This blend of speed and contextual relevance is why embedded lending is becoming so attractive to businesses and end users alike.

The benefits of embedded lending

For platforms

Embedded lending strengthens the bond with customers, builds loyalty, and creates new sources of revenue. A SaaS provider that gives access to working capital is no longer only a tool but also a partner in growth.

For consumers and SMBs

The biggest advantage for consumers and SMBs is reduced friction. Borrowers gain faster access to credit, more flexibility in repayment, and less reliance on traditional banking paperwork. A retailer’s customer can spread out payments, while a small business can unlock capital to cover payroll or inventory with minimal hassle.

For lenders

The appeal lies in richer data and more efficient customer acquisition. Rather than relying solely on credit bureaus, lenders gain real-time insights into user behaviors that create a clearer picture of creditworthiness.

This convergence of convenience and opportunity explains why the embedded lending market is projected to grow into the trillions over the next decade.

The role of AI and advanced data

Artificial intelligence is more than a tool that supports lending. It is a force that drives the rapid growth of embedded credit. AI can work with large and diverse datasets to create more accurate credit scores. This is especially valuable for borrowers who have limited credit histories. By joining financial transactions with platform activity and other signals, AI helps open access to credit for people who were often left out before.

AI adds stronger protection against fraud and sharper tools for managing risk. It can detect unusual activity as it happens and shield both platforms and lenders. At the same time, it improves the customer experience by shaping offers to the individual, giving instant approvals, and setting loan terms that match each borrower’s needs.

This marriage of embedded finance and AI is transforming lending into a more inclusive, responsive, and secure process.

Challenges and risks

Regulation

Rules are still catching up. Many jurisdictions are adapting frameworks to govern non-bank credit distribution, particularly around consumer protection and responsible lending. Clear guidance will be key for growth without legal uncertainty. A stable legal base will also give both lenders and platforms the confidence to expand.

Data privacy and security

With sensitive financial and behavioral data flowing between platforms and lenders, data governance and compliance are non-negotiable. Users will only trust the system if their information is protected.

Credit risk and over-borrowing

Sensitive financial and behavioral data move between platforms and lenders. This makes data governance and compliance essential. Users will only trust the system if their information stays secure. Clear rules for data use will also support long-term adoption.

Fraud prevention

Repayment models must reflect real cash flow, especially for small businesses where revenues often rise and fall. Flexible schedules give these businesses stability and reduce the chance of missed payments. This balance supports growth for the borrower and lowers risk for the lender. When all these practices come together, companies gain new value and protect the long-term health of the ecosystem.

Market trends and outlook

The momentum is undeniable. Stripe forecasts the embedded finance market could approach $385 billion by 2029, while Pipe projects the broader embedded finance opportunity to reach over $7 trillion by 2030. Much of this growth will come from the business-to-business space, where SMBs increasingly expect financing to be available inside the platforms they already rely on.

As more platforms move beyond pure services and into financial enablement, embedded lending will shift from being a differentiator to a core expectation. The winners will be those who balance user experience with robust risk management and compliance.

Source: arya.ai

Best practices for platforms and lenders

For organizations that move into embedded lending, several lessons stand out.

- Strong partnerships are essential, and both sides must agree on risk appetite, compliance, and technology.

- Clear and simple loan terms are just as important because they build trust and encourage customers to return. Investment in AI and machine learning should be paired with oversight to avoid bias.

- Repayment models must reflect real cash flow. This is especially true for small businesses where revenues often rise and fall. Flexible terms help these businesses stay stable and lower the risk of default. When companies follow these practices together, they create new value and protect the long-term health of the ecosystem.

Conclusion

Embedded lending is more than a feature. It is a major shift in how credit is delivered. Loans placed directly inside platforms, supported by real-time data and AI, make finance faster, smarter, and easier to reach.

The opportunities are immense: platforms can become indispensable growth partners, lenders can deepen their reach and insights, and businesses and consumers can access the capital they need, when they need it.

The main challenge now is execution. Companies must put compliance, trust, and technology at the center of their strategy. Those that succeed will lead the next decade of lending. They will set the standards for the industry and win the confidence of customers and regulators. Companies that resist change will be left behind in a world where credit flows naturally through daily life.