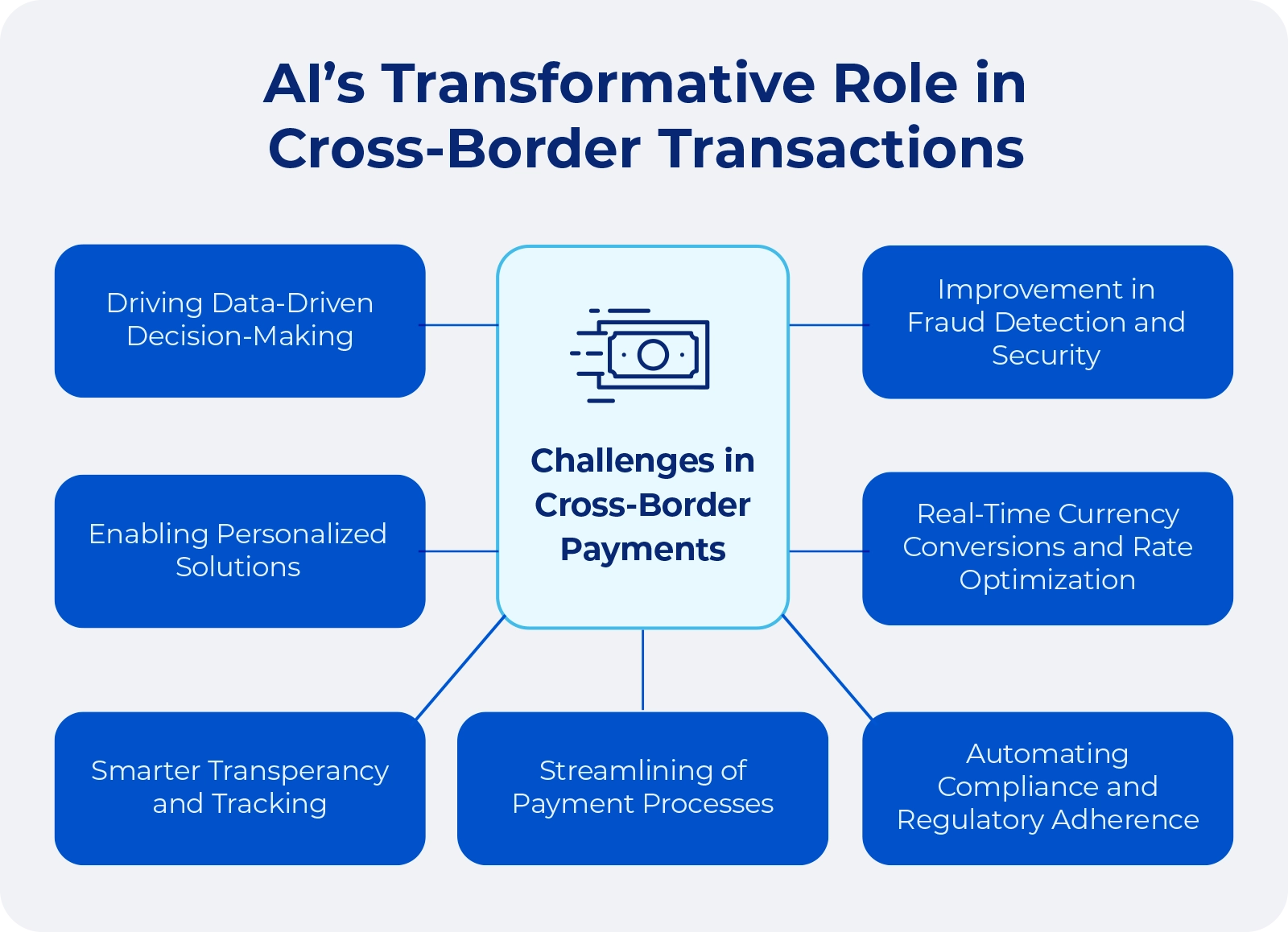

International money transfers move slower than domestic ones. They often cost more and lack transparency and the systems behind cross-border payments remain outdated. However, AI is starting to change how institutions handle these transactions. This shift is already bringing new advantages to banks, companies, and customers.

AI now opens space for new ideas. Predictive analytics help improve currency conversion while algorithms based on machine learning strengthen security. These tools are reshaping what global finance can achieve. As rules tighten and customers expect more, banks that adopt AI gain an edge in a changing industry.

This change arrives at an important time. The G20 has outlined ambitious targets for speeding up cross-border payments. By 2027, 75% of international transfers should reach their destination within one hour. Achieving this will require a complete overhaul of payment systems, with AI at the core of that transformation.

The traditional cross-border payment landscape

International money transfers still depend on a chain of correspondent banks. Each transaction passes through several intermediaries, which slows the process, increases costs, and reduces transparency. A single payment may move across many banks before it reaches its destination, with each bank adding both time and fees along the way.

Despite years of innovation, the cross-border payments market continues to struggle with inefficiencies and structural challenges that hold back progress. While the SWIFT network provides a standard way for banks to exchange payment instructions, it does not move money itself. Settlement still depends on agreements between banks.

For businesses that trade internationally, this creates long settlement times, difficult cash flow planning, and unstable costs. Small and medium-sized companies are affected the most. They rarely have the leverage to negotiate better terms with banks.

AI-powered solutions transforming global payments

Artificial intelligence is changing cross-border payments in many ways. Machine learning spots patterns in big datasets, which makes routing faster and natural language processing cuts compliance delays by automating document checks.

Payment infrastructure providers use these tools to raise straight-through processing rates (completed automatically from start to finish without any manual intervention) while automation reduces manual work and friction, so international transfers move faster while still meeting compliance rules. Some providers now achieve more than 99% straight-through processing, a result once thought impossible.

AI systems also monitor global payment networks in real time. They select the best routes for each transfer, which lowers delays and costs. With every transaction, the system improves its choices, creating continuous progress.

For banks, working with payment providers is often better than rebuilding old systems. These partnerships help banks deliver modern international payments fast and at lower cost. Through API links to global networks, banks extend their reach while staying in control of the customer relationship.

Enhancing fraud detection and security

Faster payment processing introduces new security challenges, and AI is well-suited to solve them. As transactions move quicker, there is less time for manual checks, so banks must rely on advanced automated measures. Machine learning fits this role, since it can weigh many risk factors at once and approve or block payments in an instant.

Fraud detection today depends on vast networks of specialized algorithms. They track how transactions behave and point out unusual patterns that may signal fraud. These systems can scan millions of data points in a single second and apply several layers of checks to each transfer and they do all this without slowing payments.

AI strengthens security not only through transaction checks but also through better identity verification. Biometric scans, document checks, and behavioral analysis combine to form a layered defense that is strong and easy to use. These methods confirm customer identities with more accuracy than older systems and at the same time make the process smoother for users.

Streamlining compliance and regulatory requirements

Regulatory compliance is one of the most demanding parts of cross-border payments. Banks must meet complex rules in different regions, and mistakes can bring heavy penalties. Traditional methods rely on manual document checks, which slow transactions and create costly delays.

AI is changing this through automation and better risk assessment. Natural language tools can read documents far faster than people, pull out key details, and highlight possible issues for review. This reduces processing times while keeping compliance thorough.

KYC and AML checks gain particular strength from AI. Machine learning can study customer behavior and spot suspicious patterns with more accuracy than rule-based systems. This lowers false positives and lets teams focus on the cases that matter most.

Furthermore, regulations continue to shift but AI adapts well to this environment because it can be updated quickly to meet new standards without a full system rebuild. This flexibility allows banks to stay compliant while limiting the cost and disruption of regulatory change.

Optimizing currency exchange and liquidity management

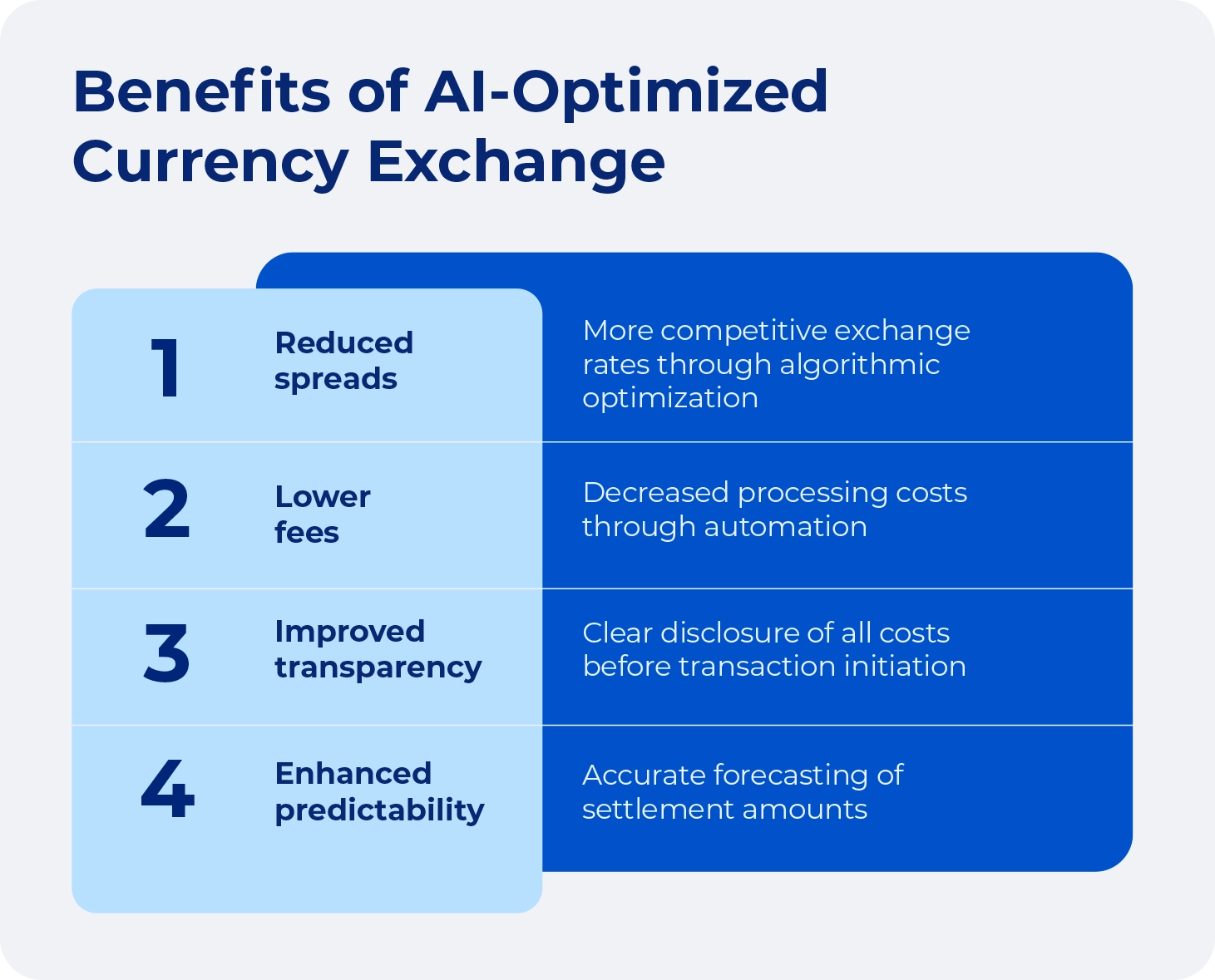

Currency exchange is a major cost in cross-border payments, and traditional methods often leave customers with poor rates. AI systems improve this process by watching market conditions in real time and finding better moments to exchange, which lowers costs.

Modern payment platforms use advanced algorithms to track currency markets and act when rates are most favorable. They can also group many small transfers into larger blocks, giving access to wholesale rates that individuals normally cannot reach. This leads to real savings that providers can pass on to customers.

AI improves exchange rates and strengthens liquidity management in cross-border payments. Predictive analytics forecast transaction volumes and currency demands. With this insight, banks can place liquidity more effectively across global operations.

For global businesses, the benefits are straightforward. Better exchange rates lift profit margins, accurate forecasts make planning finances easier. In addition, lower costs and greater transparency combine to deliver a much stronger experience than traditional cross-border payments.

Delivering enhanced customer experiences

AI shapes customer experience in ways that extend far past faster payments. Modern platforms use AI to deliver personalized service at scale. They meet individual customer needs without heavy manual work, which allows financial institutions to offer high-quality service more efficiently.

Communication is one of the areas with the greatest improvement. Automated systems keep customers updated throughout the payment process. They share real-time transaction status and send alerts when issues need attention. With natural language tools, these systems can interact in a way that feels clear and conversational.

Additionally, when direct support is needed, AI tools also help service teams. They can resolve simple requests automatically and give representatives detailed context for complex cases. This ensures quick solutions while keeping the human touch where it matters most.

Source: yojji.io

Challenges and considerations in AI implementation

AI has the power to reshape cross-border payments, but adoption comes with clear challenges. Data quality is one of the most pressing ones. Algorithms require vast and accurate datasets, so banks need solid data management systems to provide dependable inputs.

Regulation creates added pressure. Supervisors expect AI in finance to be transparent, fair, and explainable. To meet these standards, banks often create governance frameworks designed specifically for AI.

Old infrastructure is another barrier. Many core banking systems were built long before AI and do not connect with it easily. Seamless integration requires careful planning and significant investment, which forces banks to weigh costs against expected gains.

The future outlook for AI in cross-border payments

AI in cross-border payments is not a finish line but a path that keeps unfolding. As it develops, new advances will raise the speed, security, and efficiency of international transfers.

Regulation will also keep evolving as technology develops. Leading financial institutions are working with regulators to shape standards that protect customers while allowing innovation to move forward. This cooperation supports responsible growth and strengthens the industry.

A key trend is the wider availability of advanced payment technologies. As AI-powered tools become easier to access, smaller banks and FinTech firms can use them to compete with larger players. This broader access fuels innovation and extends efficient cross-border payments to markets that were once underserved.

For businesses and consumers, the future looks bright. International payments are moving closer to the speed, low cost, and transparency of domestic transfers. Challenges still exist, but the path is clear: AI is transforming cross-border payments and unlocking new opportunities across the financial system.